| Q3 • 2024 |

TMGNorthwest

MARKET PULSE

A Snapshot of the Pacific Northwest Property Management Market

This report highlights several important trends observed in the regions where TMG offers services, including a continued high demand for single family rental homes and significant increases in turnover costs due to rising building material prices and increases in overall labor costs.

In Q3 2024, cost increases aligned with the peak rental activities during the summer months and are not representative of all quarters. Additionally, with costs including insurance and property taxes increasing by an average of 8-10% year-over-year, it is crucial for property owners and managers to be strategic regarding maintenance and upgrades. Prioritizing high-impact improvements, and ensuring properties meet current tenant expectations to remain competitive, allows for maximum rent as well as a reduction in vacant days.

There continues to be a rising demand for single family rental homes across the markets that TMG serves, as highlighted in this Q3 report, primarily due to rising homeownership costs. Single family rental homes have lower delinquency and longer-term tenancies than apartments, however, overall costs can be higher. TMG’s ability to maintain a steady market presence and incorporate effective management practices, helps property investors achieve consistent returns.

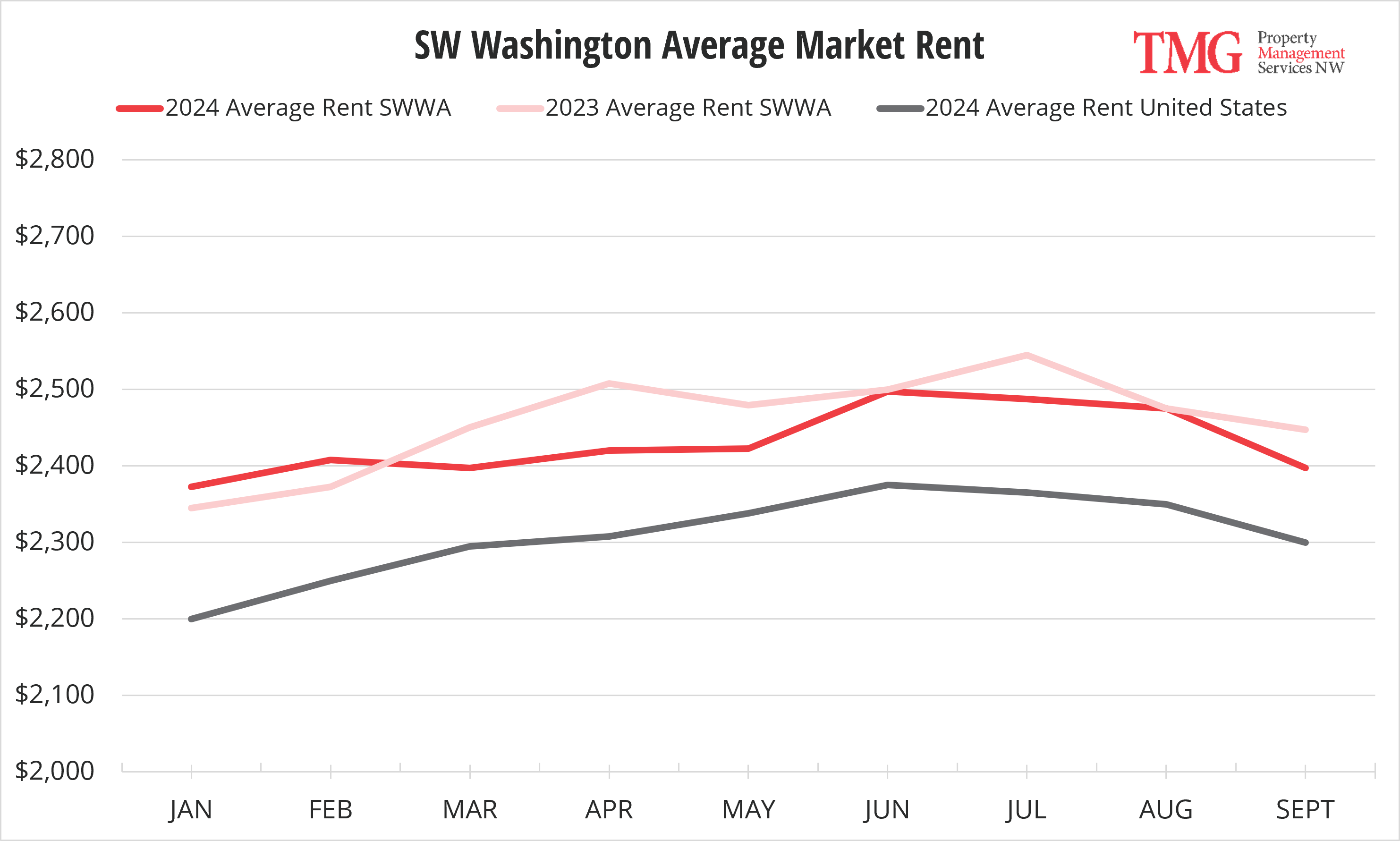

SW WASHINGTONRental Market

| Average Market Rent $2,398 |

Average Days on Market 37.5 |

Average # Years of Tenancy 4.62 |

Delinquency 1.67% |

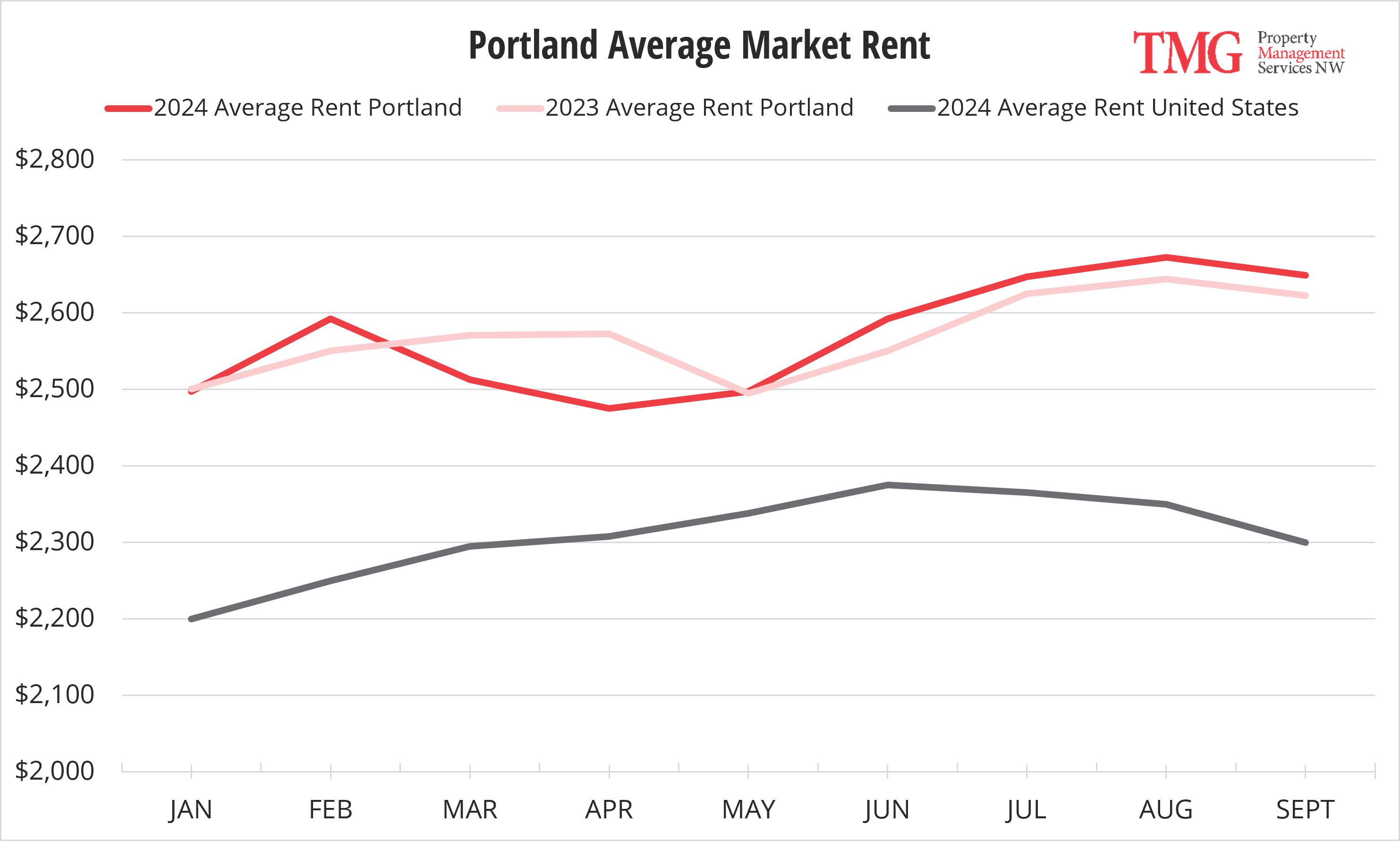

PORTLANDRental Market

| Average Market Rent $2,649 |

Average Days on Market 40.5 |

Average # Years of Tenancy 3.79 |

Delinquency 1.44% |

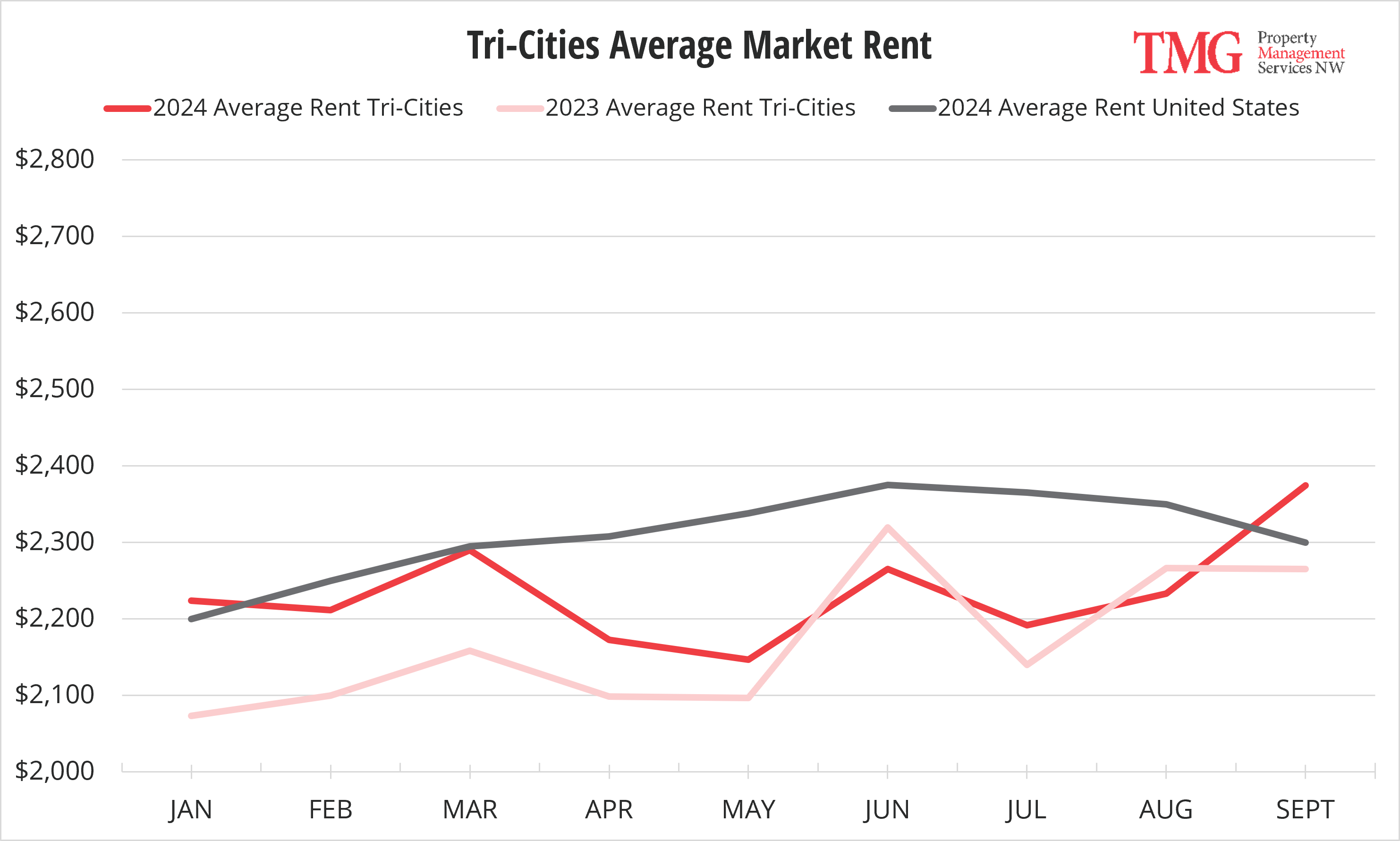

TRI-CITIESRental Market

| Average Market Rent $2,374 |

Average Days on Market 28.6 |

Average # Years of Tenancy 1.80* |

Delinquency 0.66% |

All data in this report is pulled from TMG single family rental statistics and Zillow Rental Manager Market Trends.