Loan to Value Ratio (LTV)

What Is It?

When considering how to invest in real estate, one term you may see come up time and again is loan to value ratio (LTV). It is a lending risk assessment ratio that lenders examine before approving a loan.

How Is It Calculated?

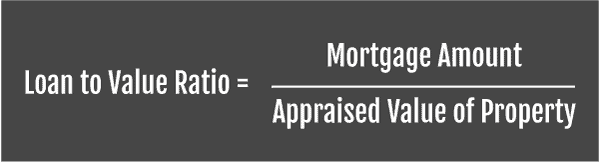

The LTV is determined by what percentage an asset’s sale price or value is attributed to financing. It's determined by dividing the mortgage amount by the appraised value of the property.

What Are the Implications?

If the borrower is requesting a loan for an amount that is at or near the appraised value (a higher LTV ratio), it's riskier for the lender. If the property was foreclosed, the lender may not be able to sell the property for an amount sufficient to cover the balance on the mortgage. This scenario may result in the lender requiring mortgage insurance, or a higher interest rate. Most lenders offer the lowest interest rate for loans with a loan to value below 80%.

Example

Higher Loan to Value

Value = $500,000 x 85% (LTV) = $425,000 loan amount

Lower Loan to Value

Value = $500,000 x 70% (LTV) = $350,000 loan amount