What Is a Debt Coverage Ratio (DCR)?

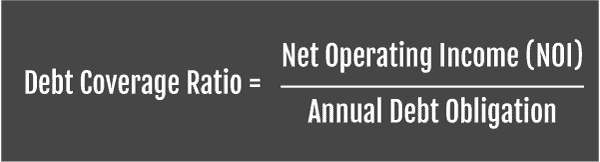

Debt Coverage Ratio (DCR), sometimes known as the Debt Service Coverage Ratio (DSCR), compares an investment property’s Net Operating Income (NOI) with its debt service.

Lenders use this ratio to calculate whether or not you will be able to generate enough income to pay your debts. Most commercial lenders require a DCR of 1.15-1.35 times the NOI divided by the annual debt service.

Example

NOI= $850,000/annual debt of $650,000 = 1.31 DCR