| Q4 • 2024 |

TMGNorthwest

MARKET PULSE

A Snapshot of the Pacific Northwest Property Management Market

As the year 2024 wrapped up, single family property values rose 6% across the year. In contrast, multifamily properties may not see the same level of appreciation or rent growth, especially in densely populated urban areas where supply is higher, competition is more intense, and rents are more regulated. This nationwide trend is clearly illustrated in the Vancouver/Portland-metro area as single family housing continues to be built at a steady pace. In Vancouver, the growth potential is greater due to less restrictions on development of single-family housing compared to Portland.

The demand among renters for single family homes remains high and is rewarded: on average a TMG single family home rents for $317/month more than higher density models. Renters are willing to pay more for the added benefits of a detached home, such as larger living areas, yards, and the perception of higher quality.

As property values continue to increase for single family homes, the lock-in effect continues to influence the sales and rental markets. Homeowners (or, inversely, renters) are reluctant to sell (or buy) because fixed rate mortgages are lower than current market rates (or they’re reluctant to purchase at high rates and wait in the hopes for rates to drop). Despite the twists and turns of the last 2 years, the market forces remain strong and single family properties continue to do well in terms of tenancy length and monthly rent values over high-density property formats.

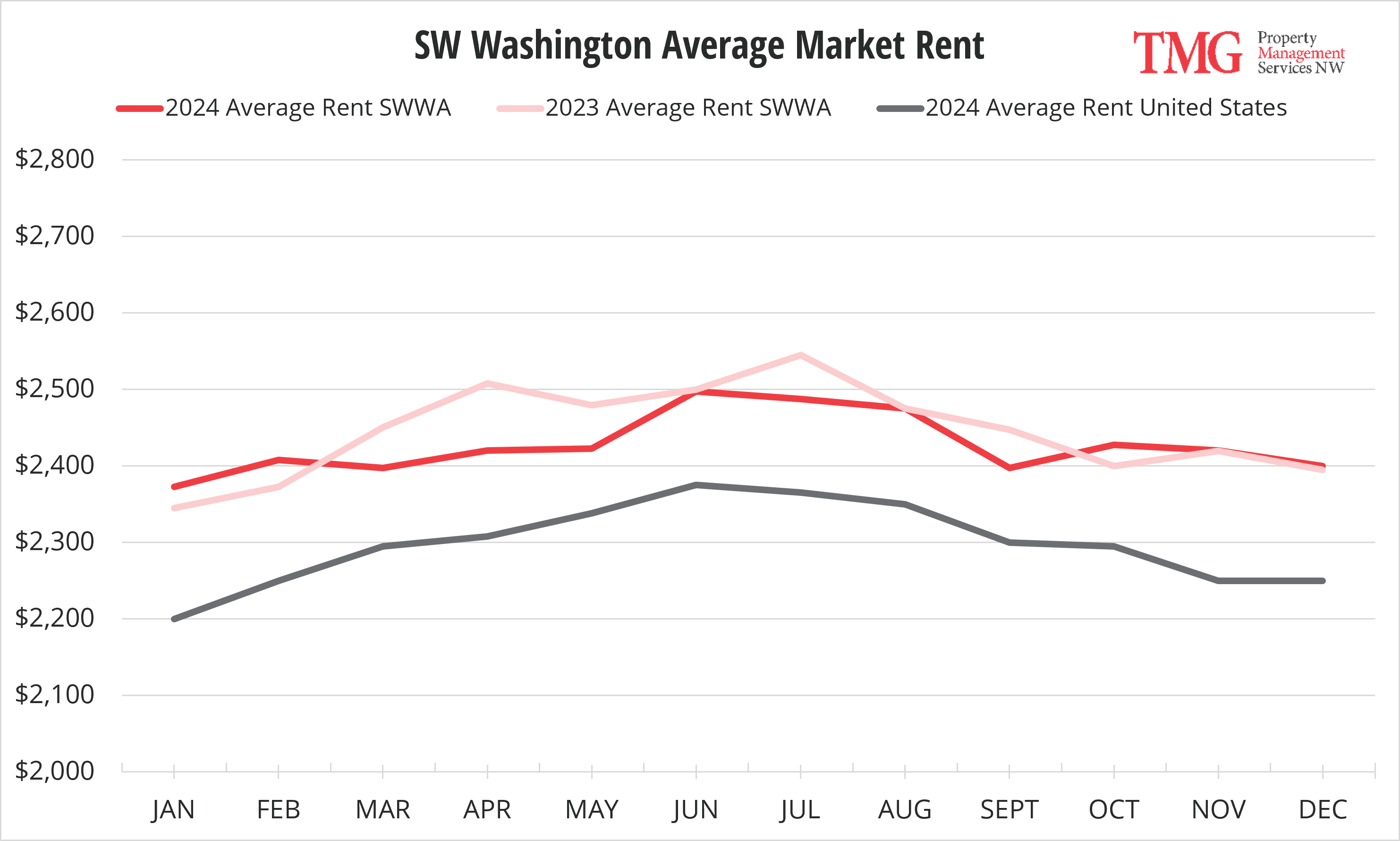

SW WASHINGTONRental Market

| Average Market Rent $2,400 |

Average Days on Market 48 |

Average # Years of Tenancy 4.62 |

Delinquency 0.52% |

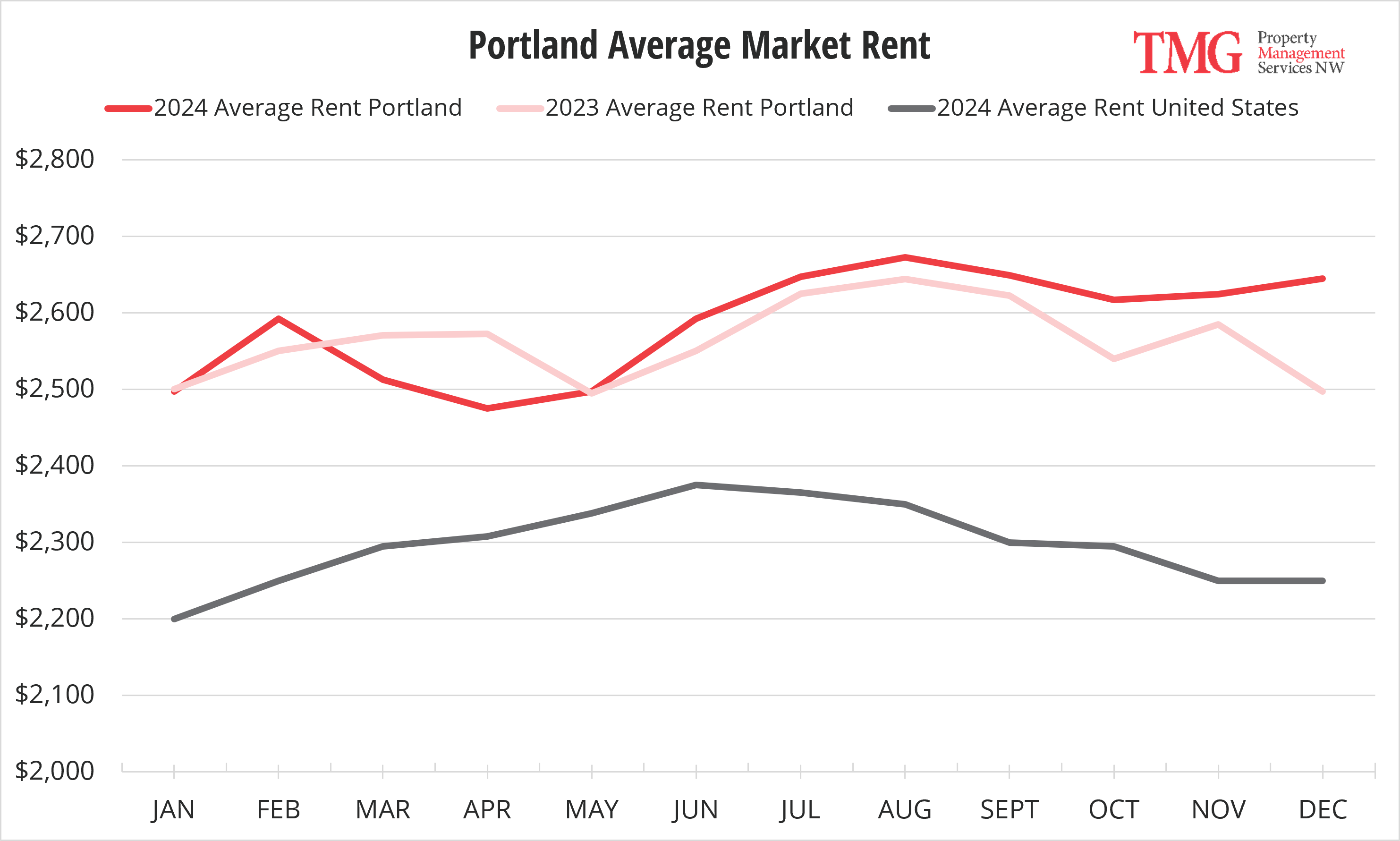

PORTLANDRental Market

| Average Market Rent $2,645 |

Average Days on Market 58.5 |

Average # Years of Tenancy 3.79 |

Delinquency 0.34% |

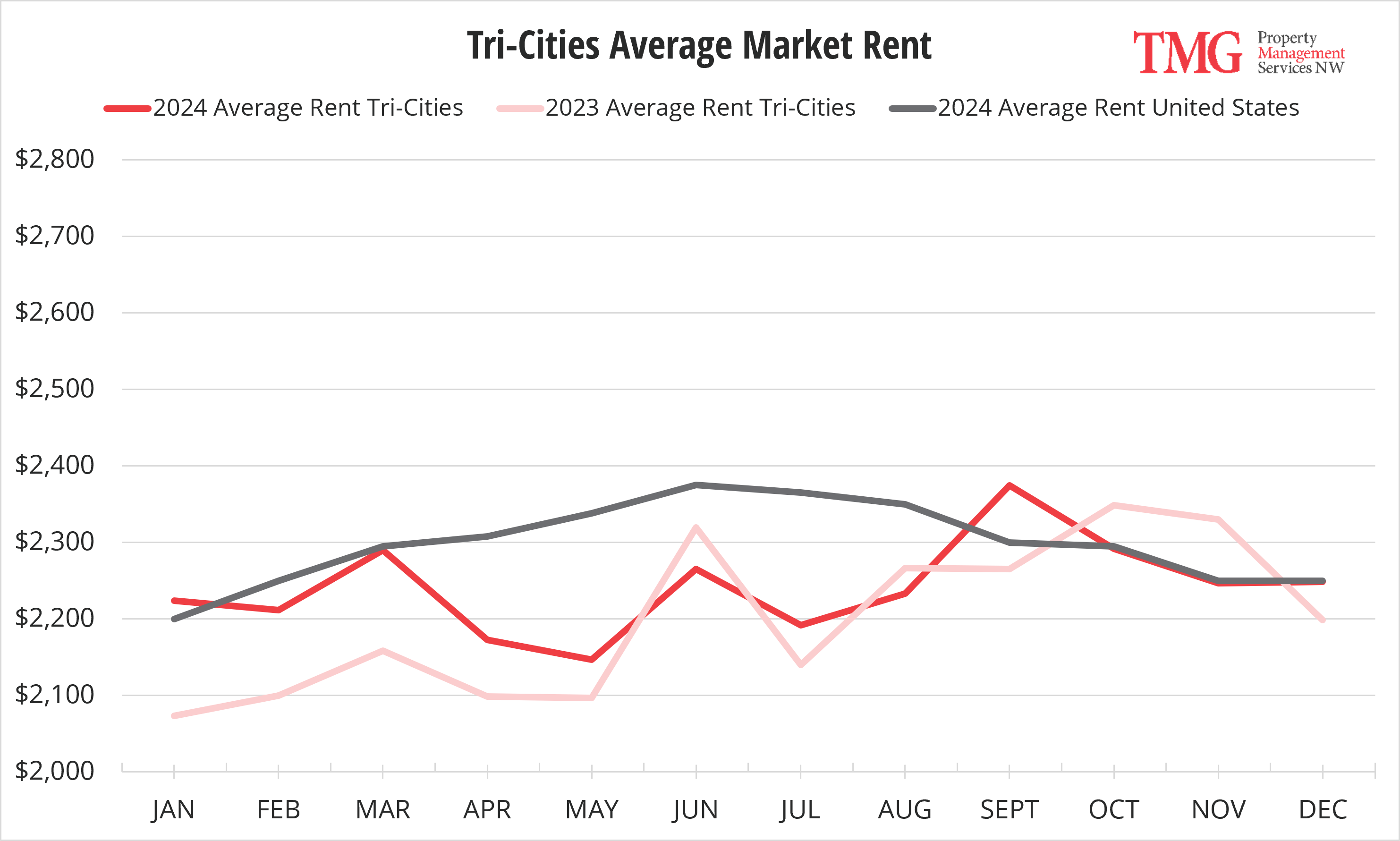

TRI-CITIESRental Market

| Average Market Rent $2,248 |

Average Days on Market 36.6 |

Average # Years of Tenancy 1.80* |

Delinquency 0% |

All data in this report is pulled from TMG single family rental statistics and Zillow Rental Manager Market Trends.