| Q4 • 2024 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

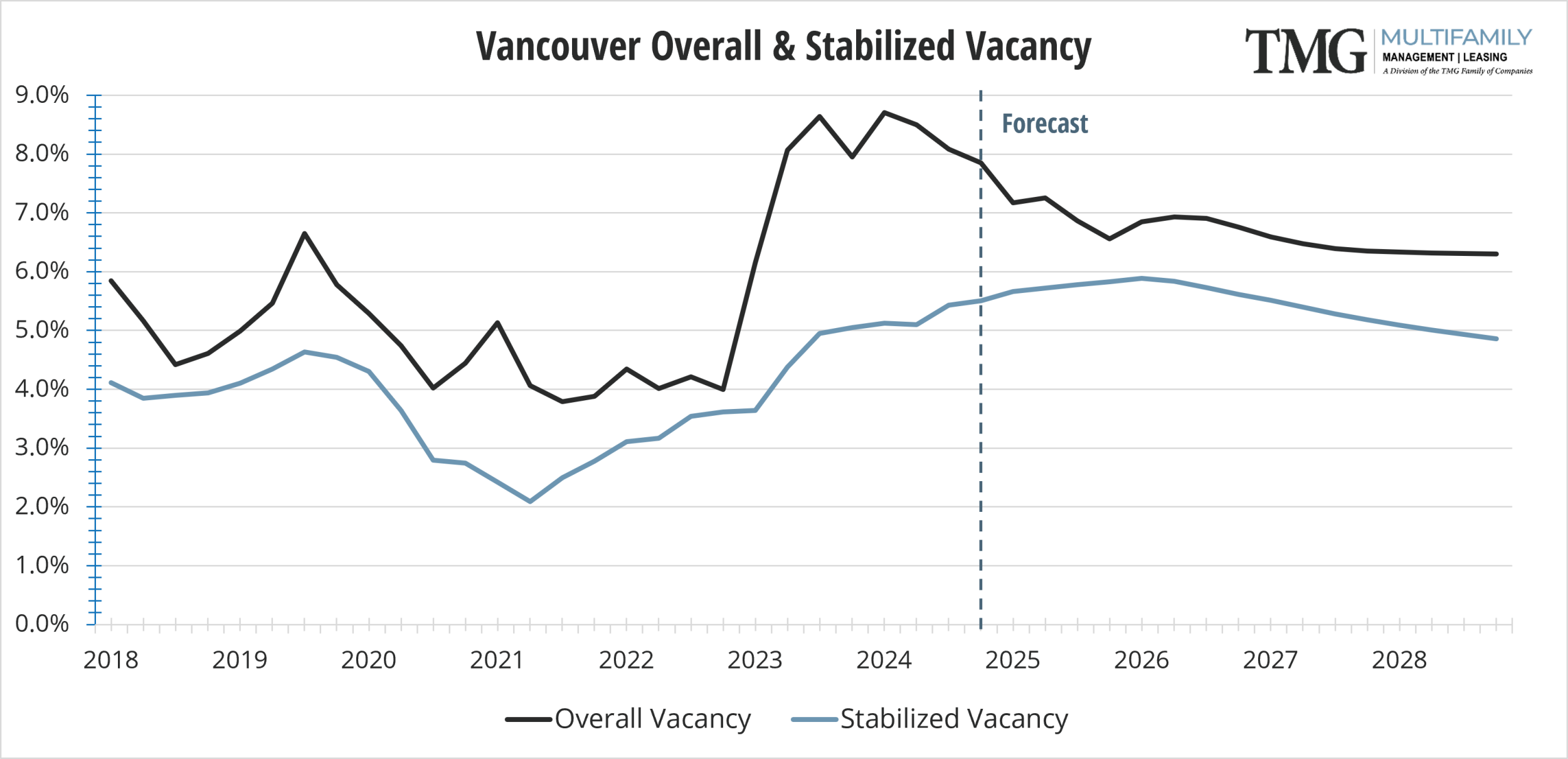

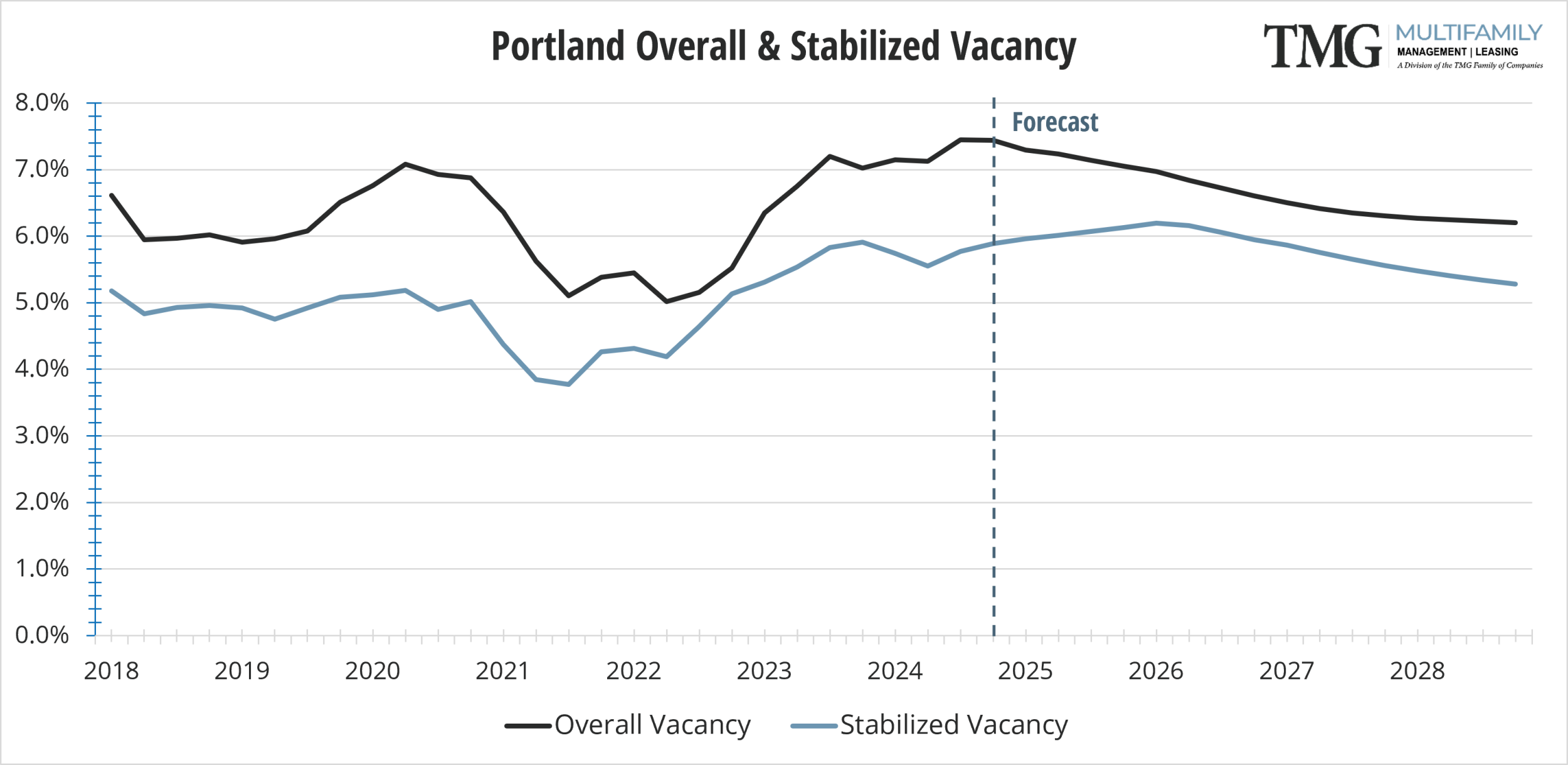

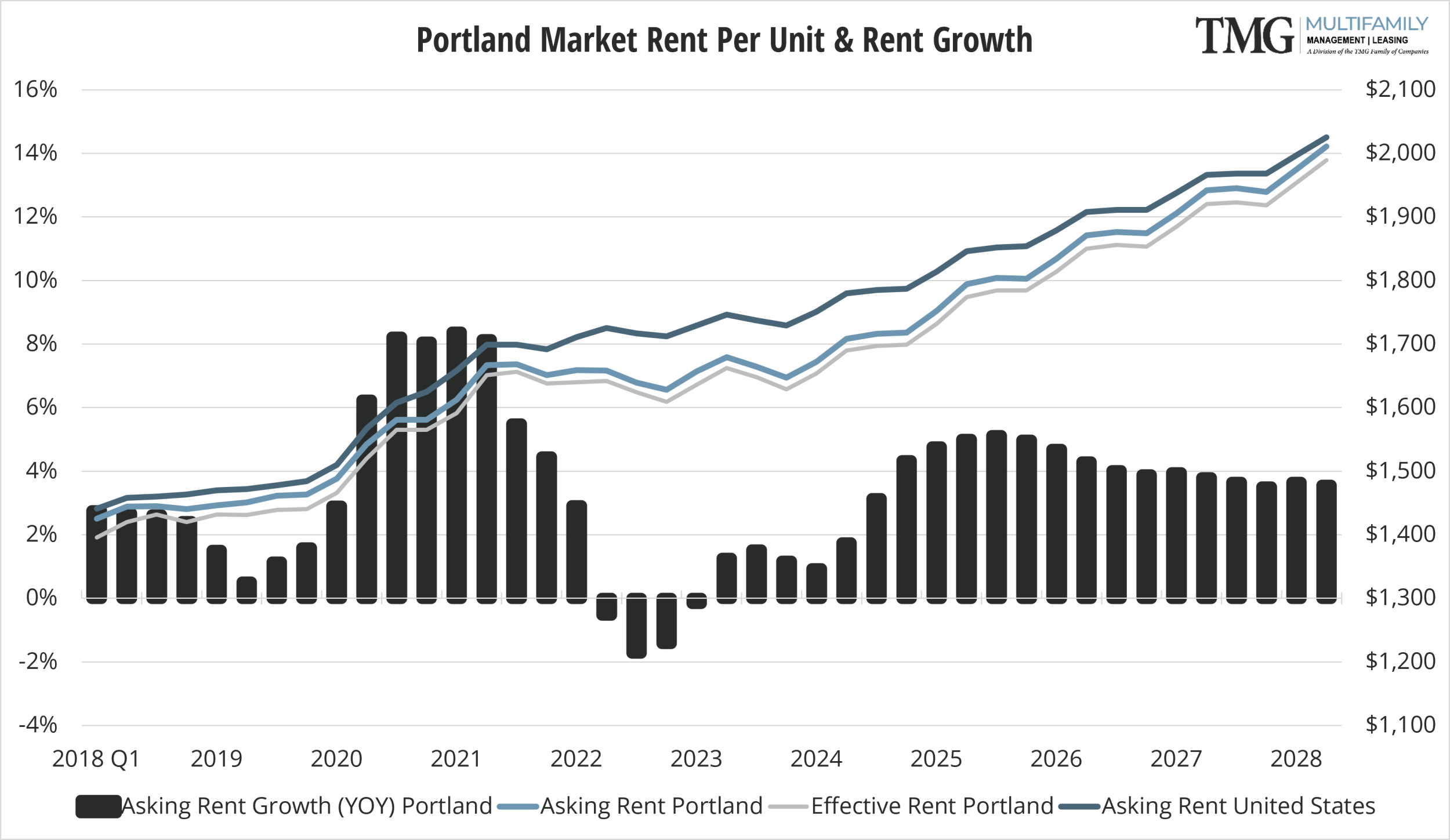

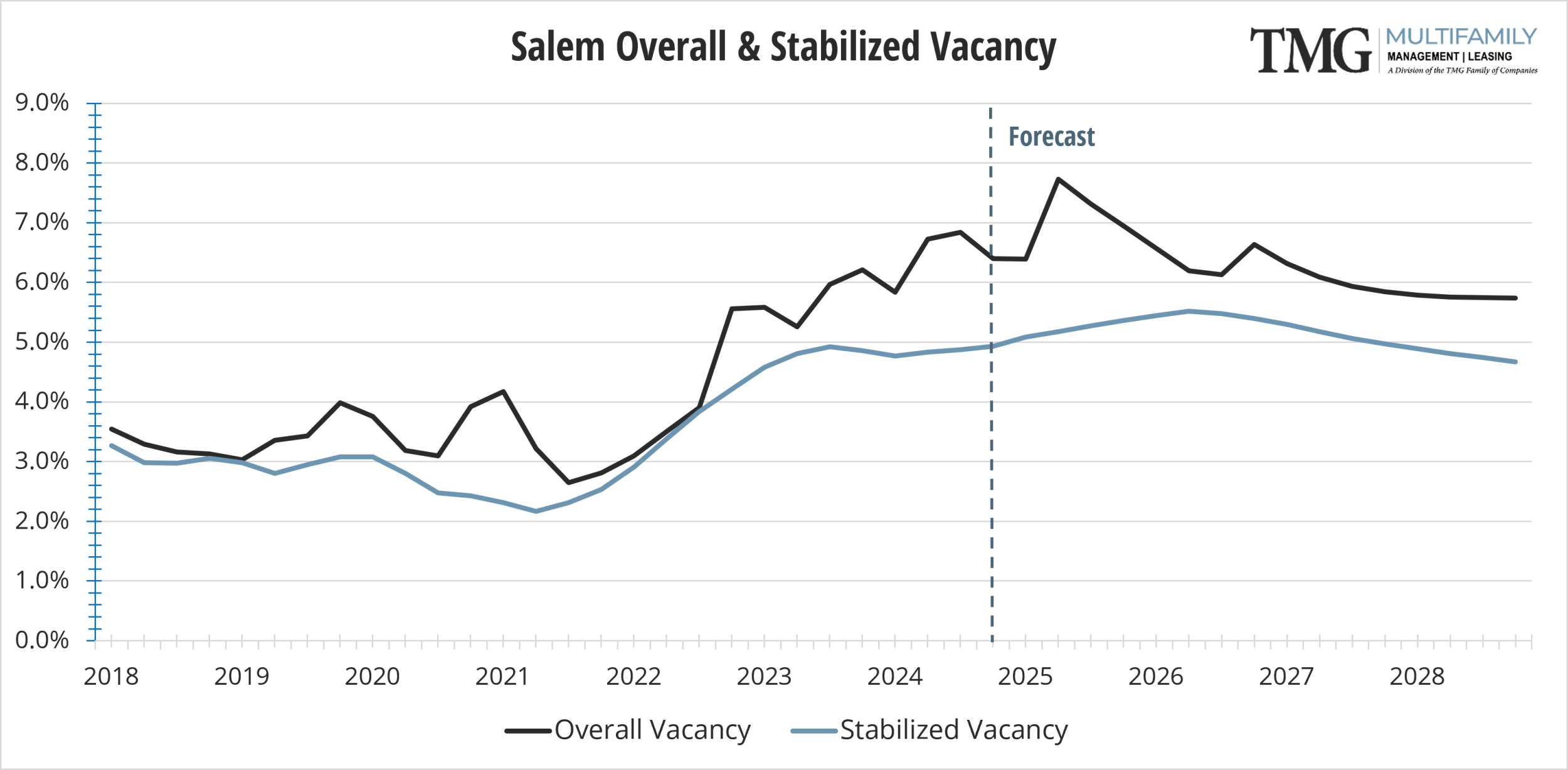

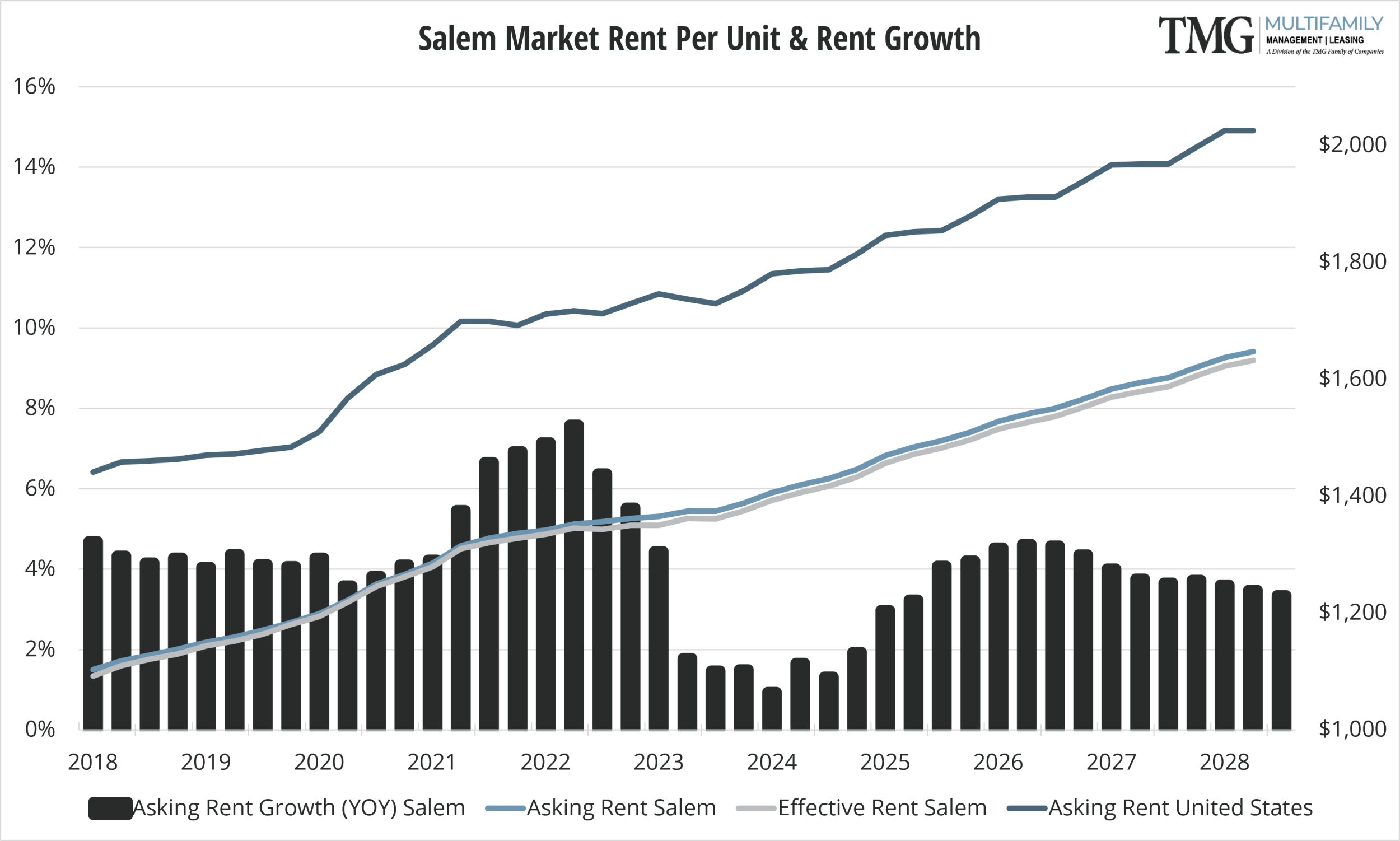

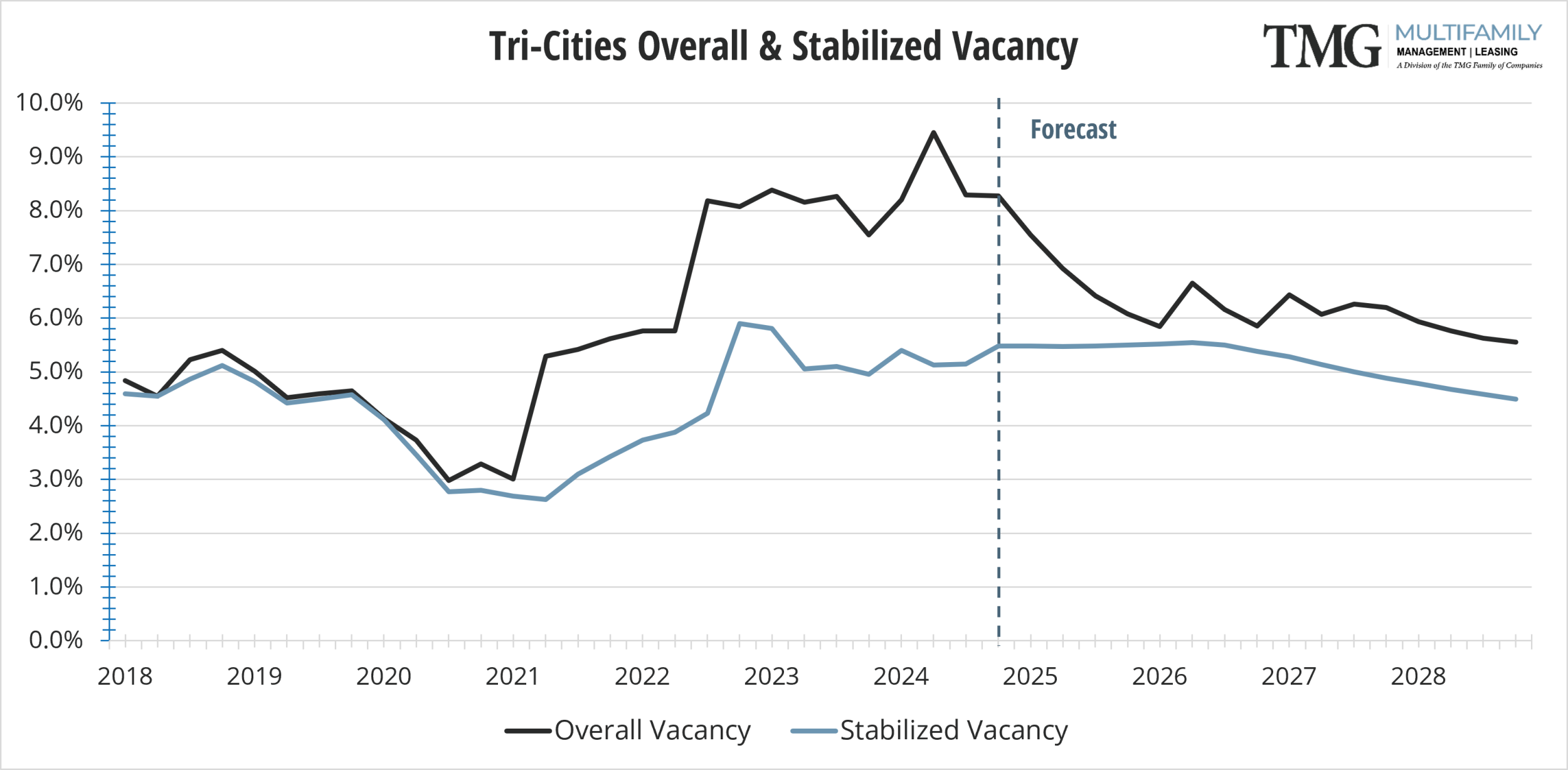

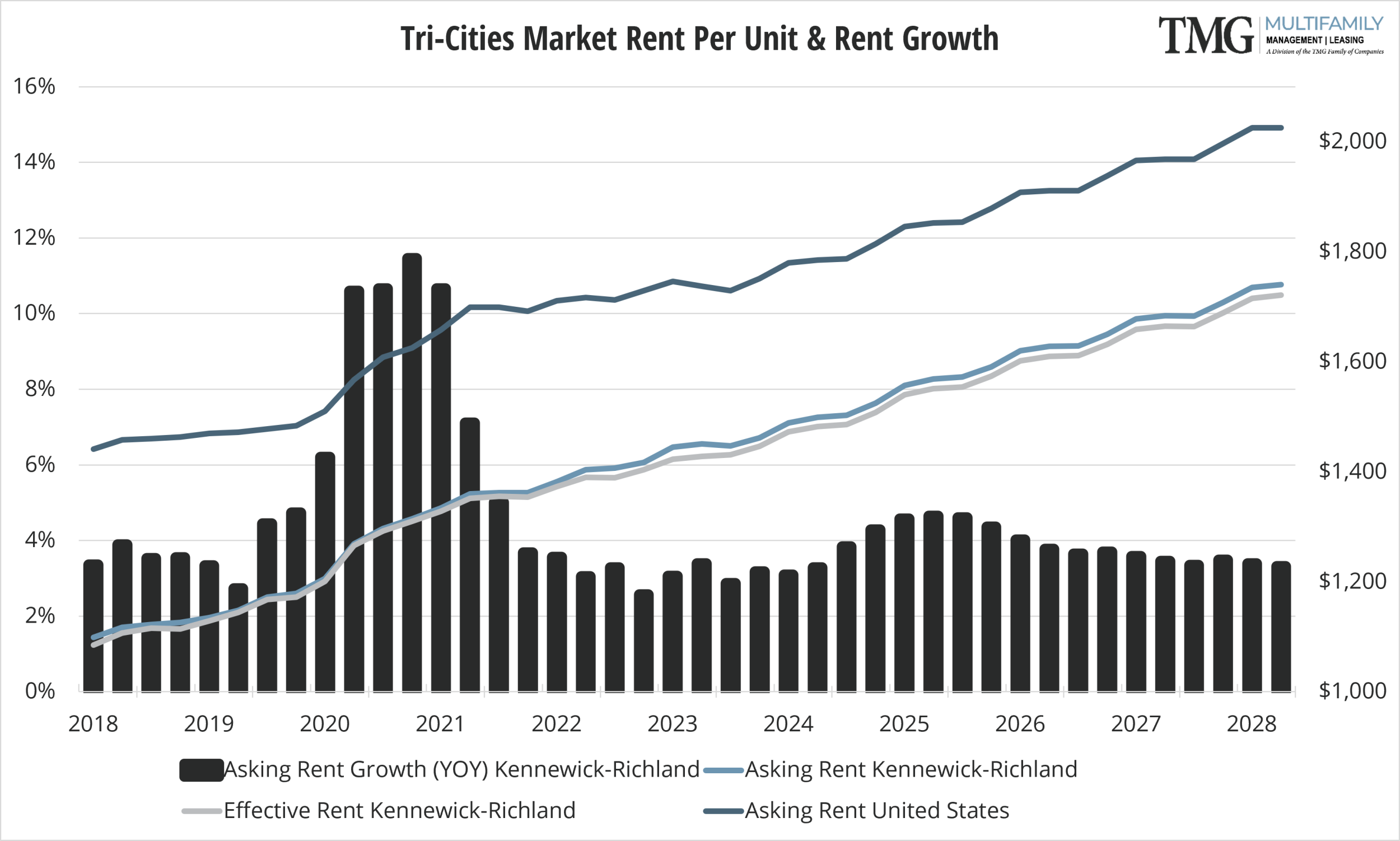

Year-over-year rent growth continues across all markets, with vacancy rates remaining within a few basis points of Q3 levels. Current projections suggest that vacancy rates are approaching their peak, driven by the completion of the majority of new housing deliveries and a significant reduction in anticipated new construction starts.

An analysis of rents by unit type in all 4 markets reveals that studios achieve the highest per-square-foot (PSF) rent; however, the oversupply of vacant studios surpasses all other unit types. In recent years, developers have significantly increased the inclusion of studios in their projects, leveraging their high PSF rent potential. Despite this, studios historically experience higher vacancy rates during economic uncertainty compared to other unit types.

Luxury multifamily developments continue to outpace mid-tier (3-star) projects, with one-month concessions standard in all markets. In densely clustered areas, concessions of two to three months are increasingly common to increase absorption. The increased dollar value of concessions coupled with reduced qualifications in some luxury properties is beginning to draw tenants from mid-tier properties.

Delinquency rates increased across all markets in Q4, which aligns with seasonal trends.

Despite the supply shock, the multifamily sector demonstrated resilience in Q4 with a 0.2% increase in effective rent and only a 10-basis-point (bps) rise in vacancy rates. As new completions are expected to slow in 2025, vacancy rates are anticipated to decline further, with stronger rent growth projected in the coming year.

All data in this report is pulled from CoStar.