| Q1 • 2025 |

TMGNorthwest

MARKET PULSE

A Snapshot of the Pacific Northwest Property Management Market

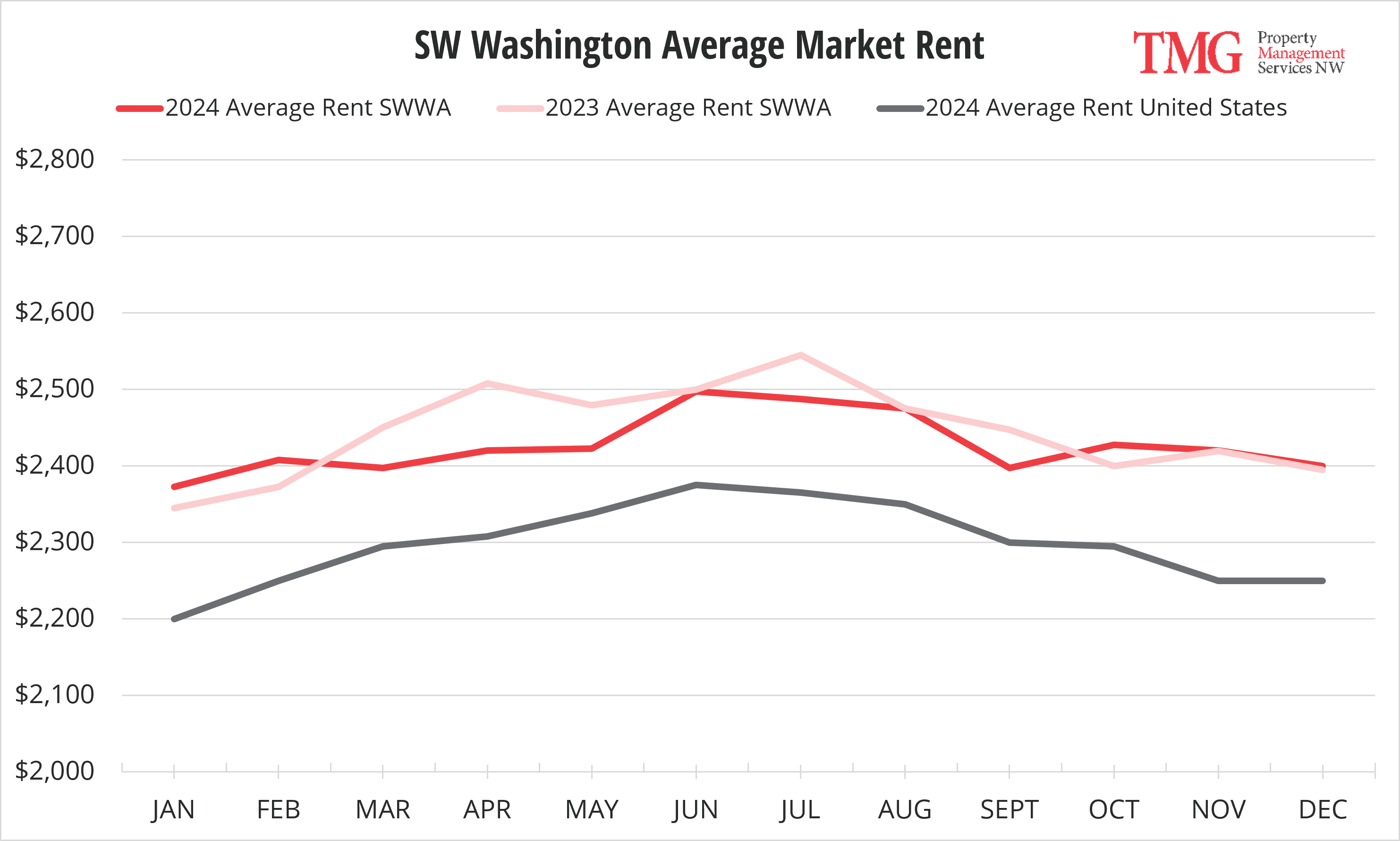

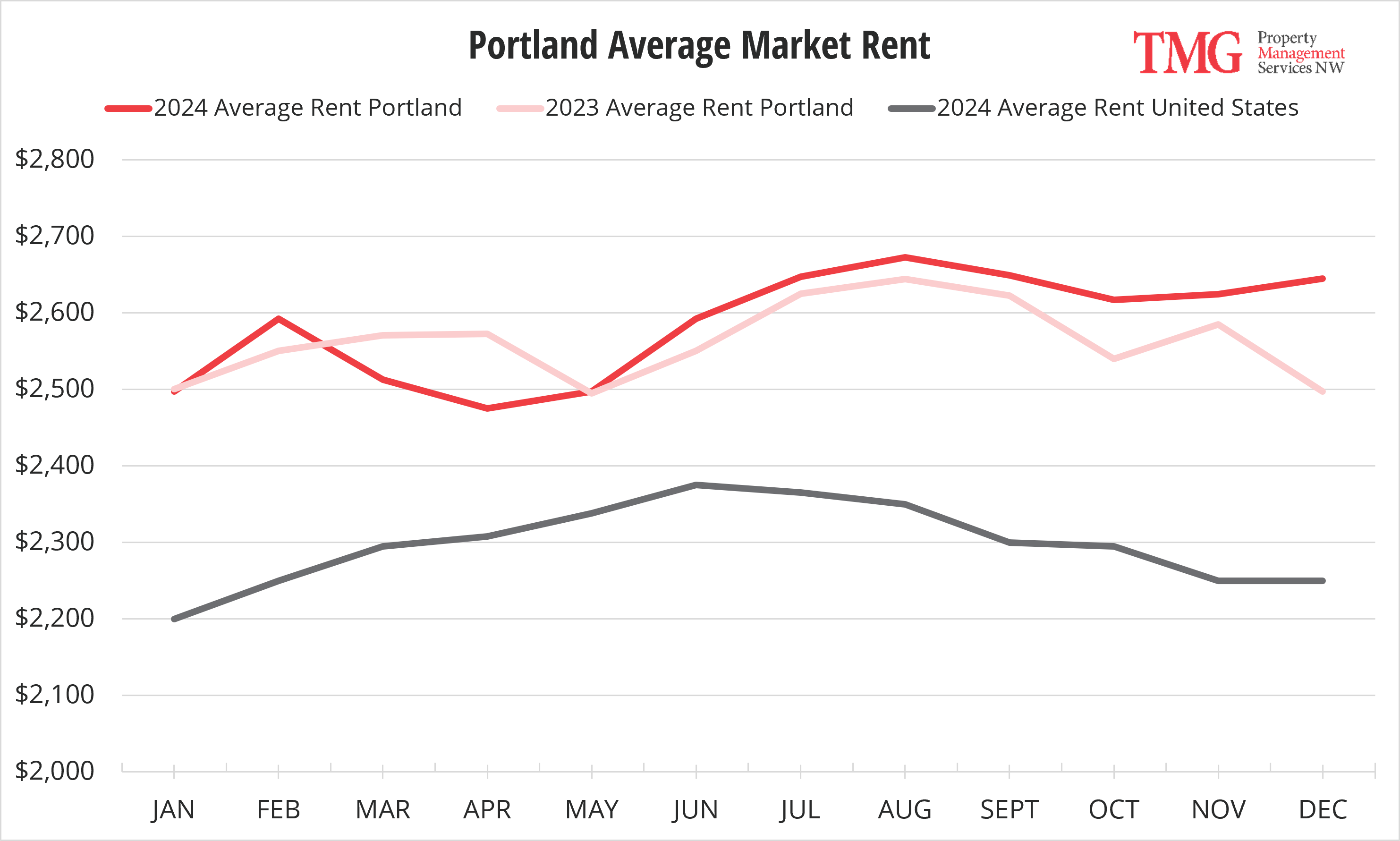

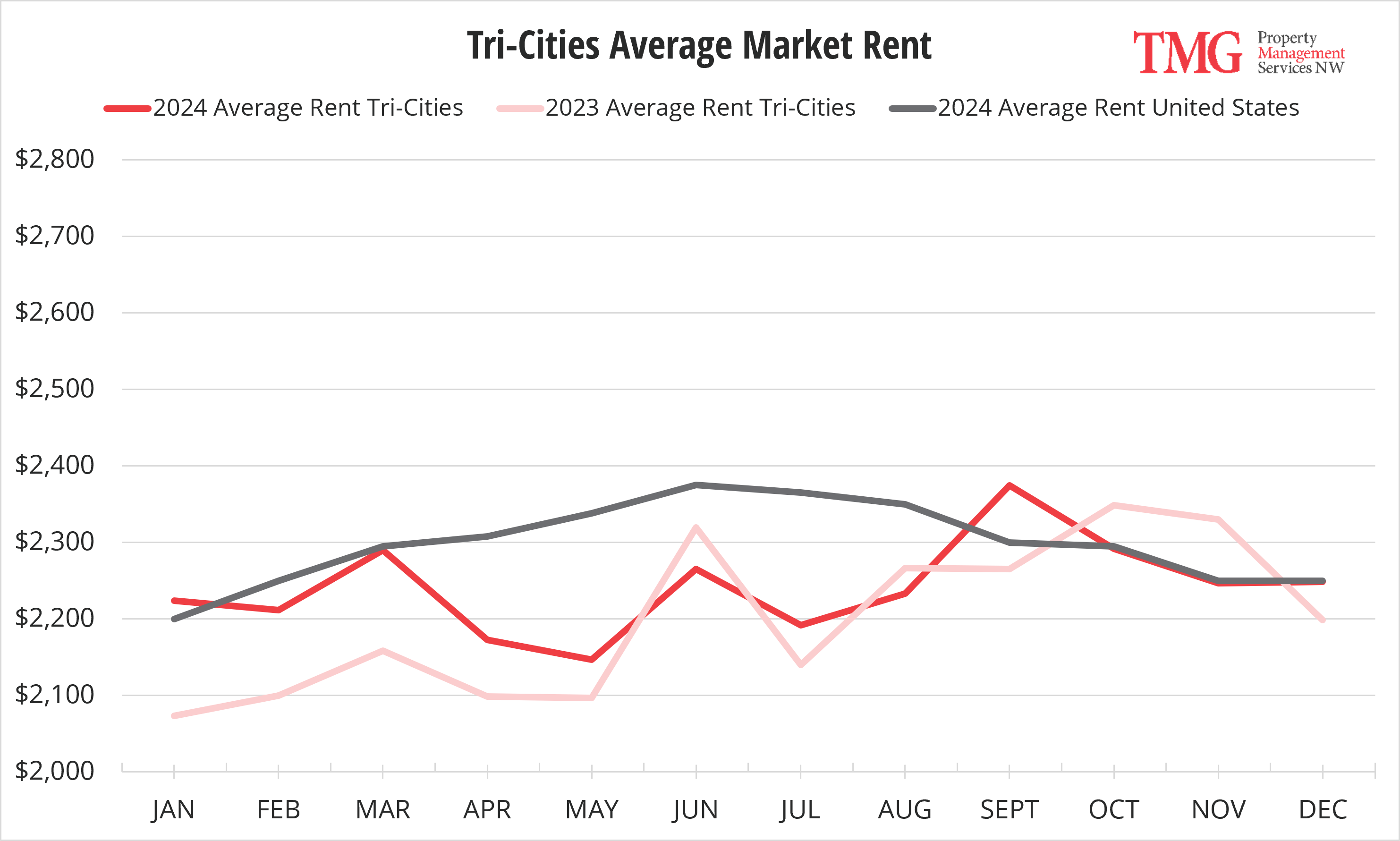

The Q1 market data reveals a resilient and steadily growing single family rental market across Southwest Washington (SWWA) , Portland-metro area (PDX), and the Tri-Cities. Amid national economic fluctuations and housing market constraints, single family homes in these regions continue to outperform higher-density housing in both demand and rent values. Portland rents rose $100/month at the start of 2025, stabilizing at $2,635, well above the national average ($2,295). Despite longer time on market (46.5 days), this indicates continued tenant willingness to pay premium prices. SWWA rents slightly decreased, aligning with seasonal trends, but still held at a strong $2,448, remaining at least $100 above the national average. The Tri-Cities was a standout, with a dramatic $200 rent spike in March that brought average rents to $2,443, exceeding the national average for the first time since early 2024. This indicates rising demand and possibly underpriced inventory in the past.

Key data points underscore strong tenant stability and low delinquency rates across all TMG-managed properties. In SWWA, tenants remain in homes for over four years on average, while Portland sees slightly shorter but still above-average tenancies. The Tri-Cities market, though newer for TMG, is quickly gaining momentum with the fastest leasing times (26 days on average).

Strategic Takeaways

- Tri-Cities is a high-growth market with strong fundamentals: low delinquency, quick leasing, and sharp rent increases.

- SWWA offers stability and long-term tenant retention, making it attractive for long-hold investors.

- Portland continues to deliver strong rents but faces more regulatory pressure and slower lease-ups.

- The Pacific Northwest single family rental market remains robust, with high demand, healthy rent levels, and promising long-term investment opportunities.

Overall, Q1 2025 reaffirms single family rentals as a strong investment class in the Pacific Northwest, with high occupancy, tenant retention, and growing rents—especially where regulatory environments are favorable.

SW WASHINGTONRental Market

| Average Market Rent $2,448 |

Average Days on Market 42 |

Average # Years of Tenancy 4.32 |

Delinquency 0.68% |

PORTLANDRental Market

| Average Market Rent $2,635 |

Average Days on Market 46.5 |

Average # Years of Tenancy 3.52 |

Delinquency 0.41% |

TRI-CITIESRental Market

| Average Market Rent $2,443 |

Average Days on Market 26 |

Average # Years of Tenancy 1.97* |

Delinquency 0% |

All data in this report is pulled from TMG single family rental statistics and Zillow Rental Manager Market Trends.