| Q1 • 2024 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

Are things looking up? It may not “feel” like it but overall, the markets in all four areas have improved slightly over Q4 2023.

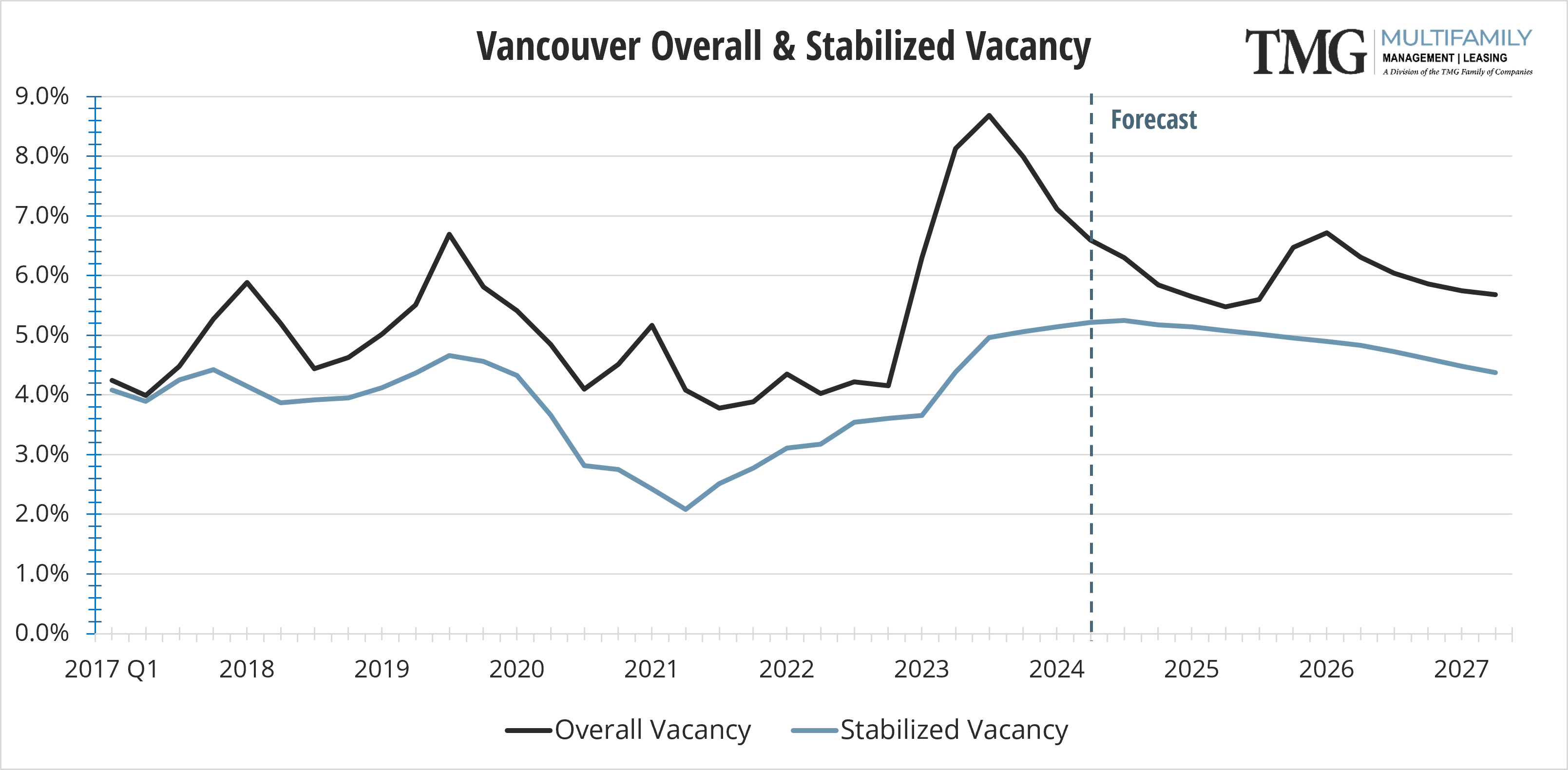

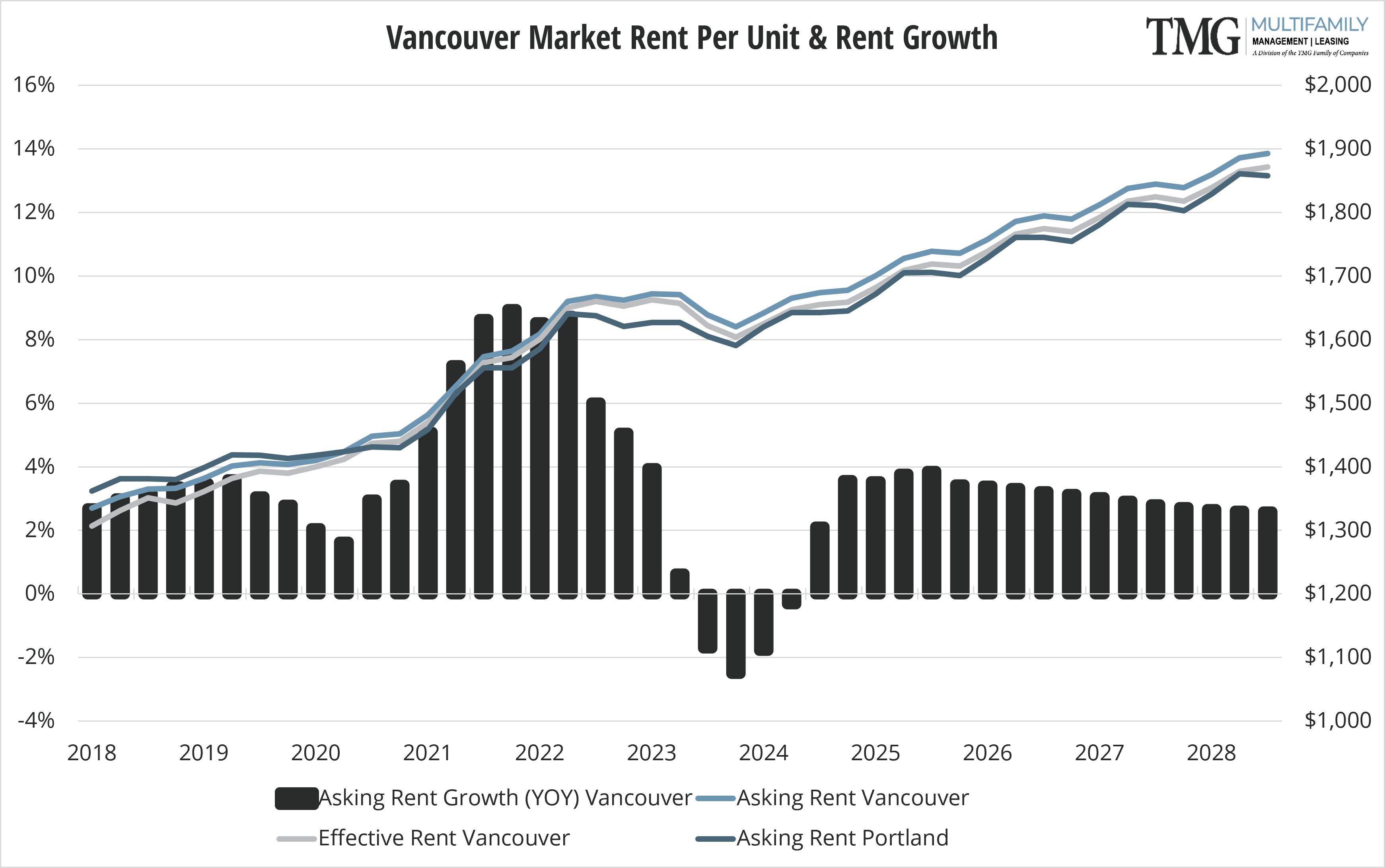

Vancouver had a significant decrease in delivered units, causing a reduction in vacancy from 8.2% in Q4 2023 to 7.1% in Q1 2024. Vancouver’s 12 month asking rent, while still in negative territory, gained a few points from a -2.5. to a -1.7.

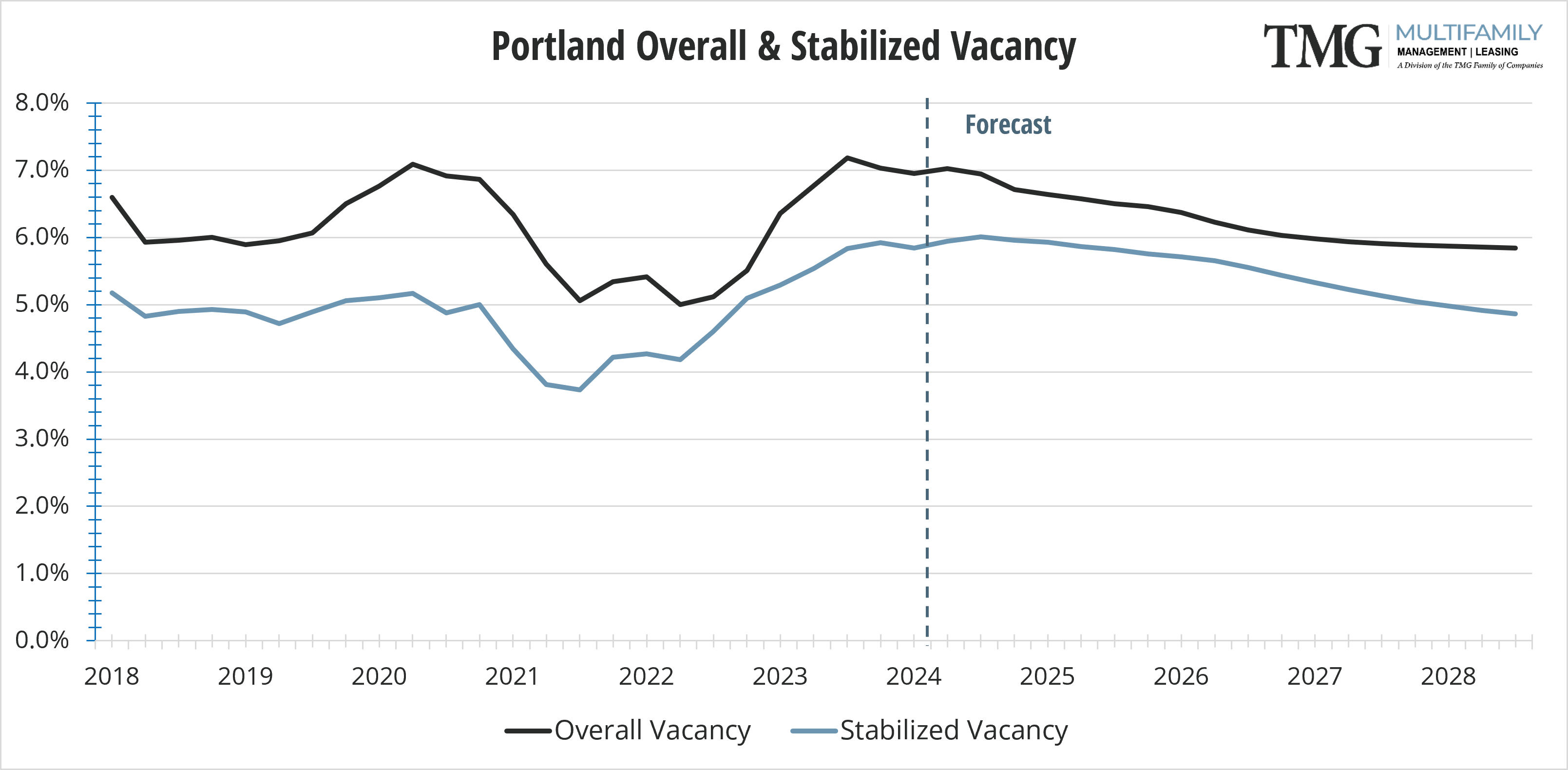

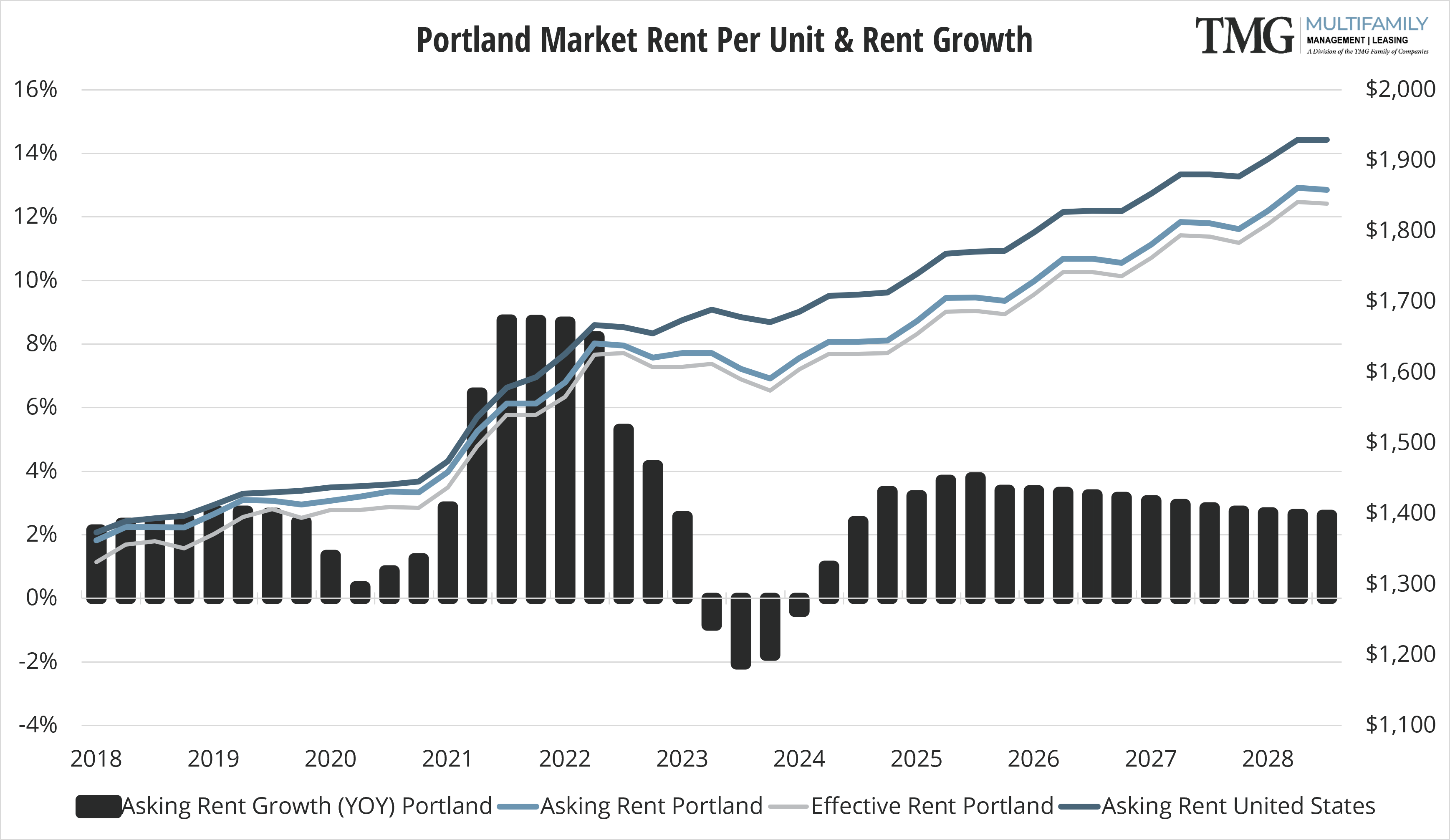

Portland also had a reduction in delivered units causing a slight decrease in vacancy rate but a significant improvement in the 12 month asking rents from a -1.9% to a -.05%.

Higher-end properties (4- & 5-star) face higher vacancy rates and concessions compared to lower-rated properties (1-,2-, or 3-star), attributed to economic conditions and housing affordability. This may turnaround in future quarters as potential homebuyers (higher wage earners) continue to be driven to the rental market as interest rates remain high and single-family home inventory remains low.

Concessions and reduced asking rent are still at play, especially on new deliveries. As I mentioned last quarter, concessions and incentives on higher end properties impacts stabilized properties, prompting some to also offer concessions. Lease-up absorption continues at a much slower pace than the highs of 2021- 2022.

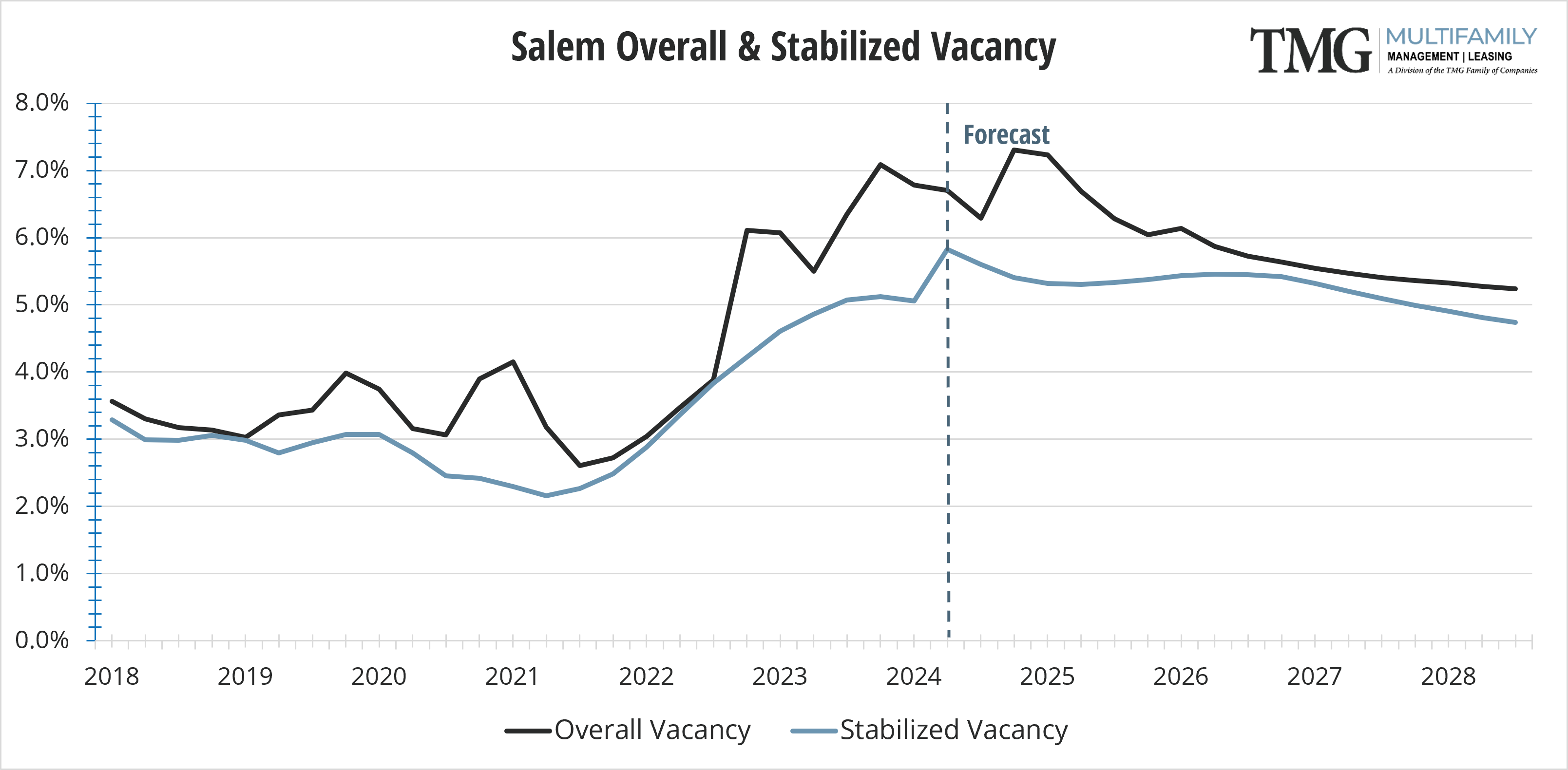

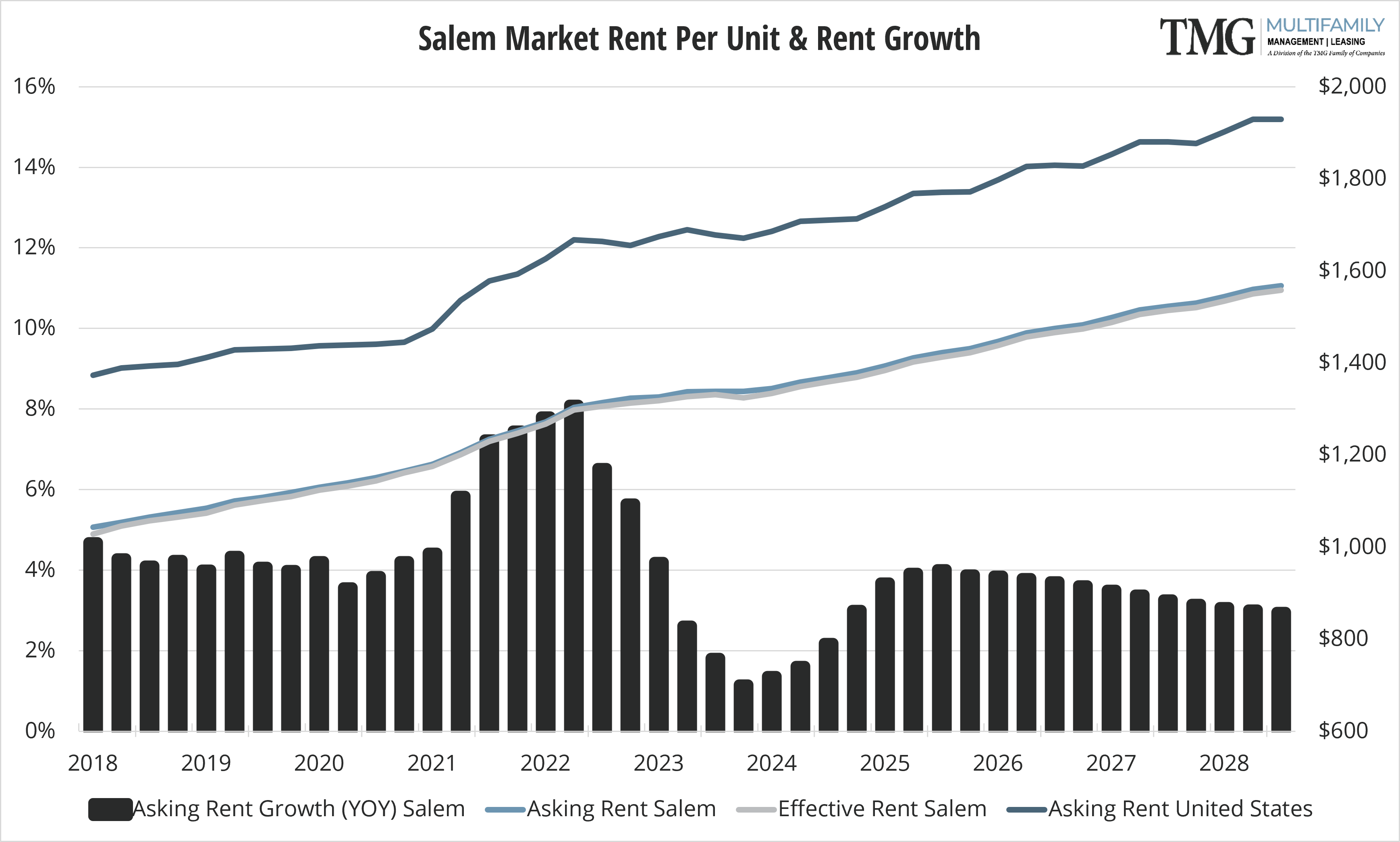

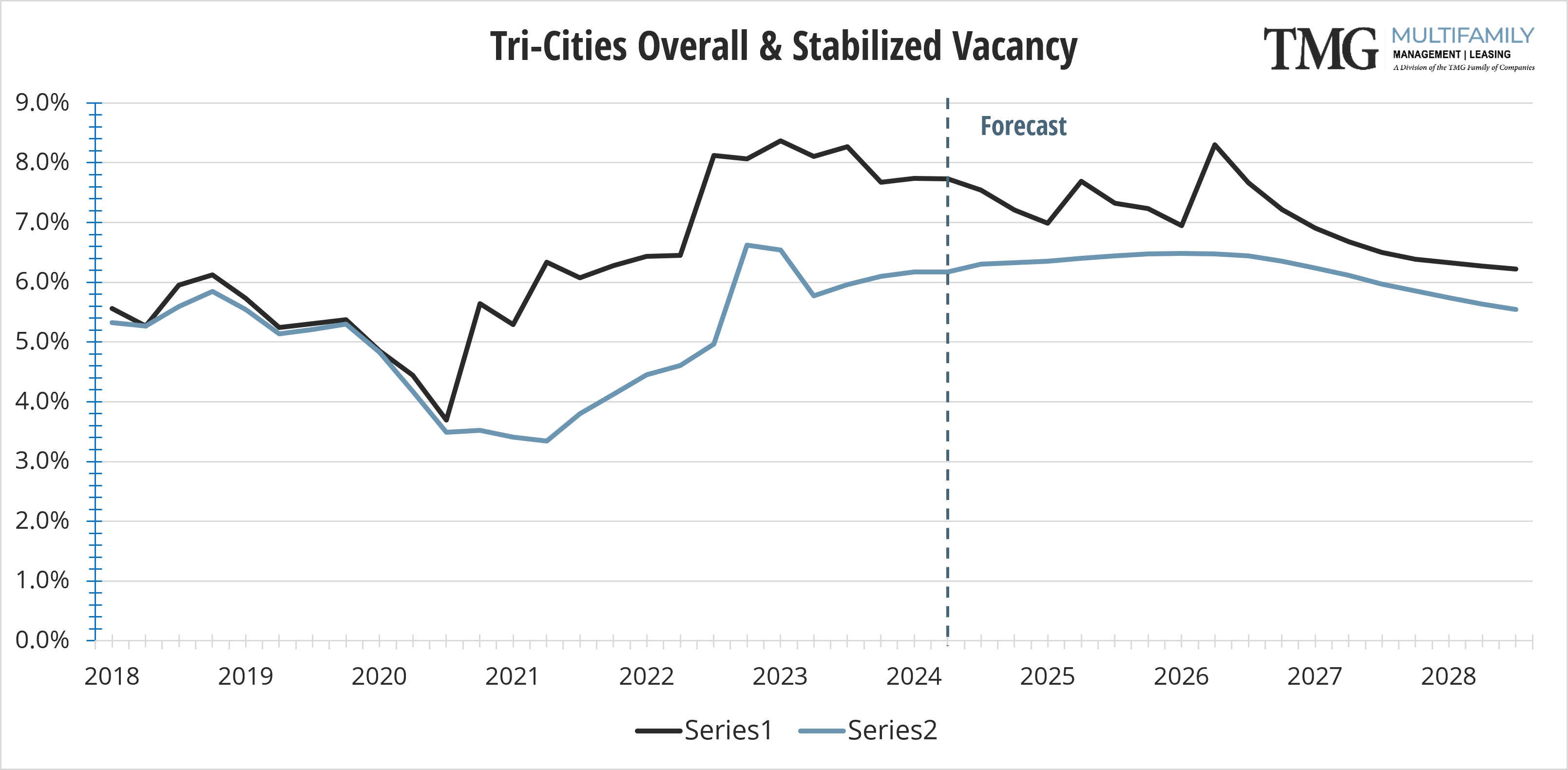

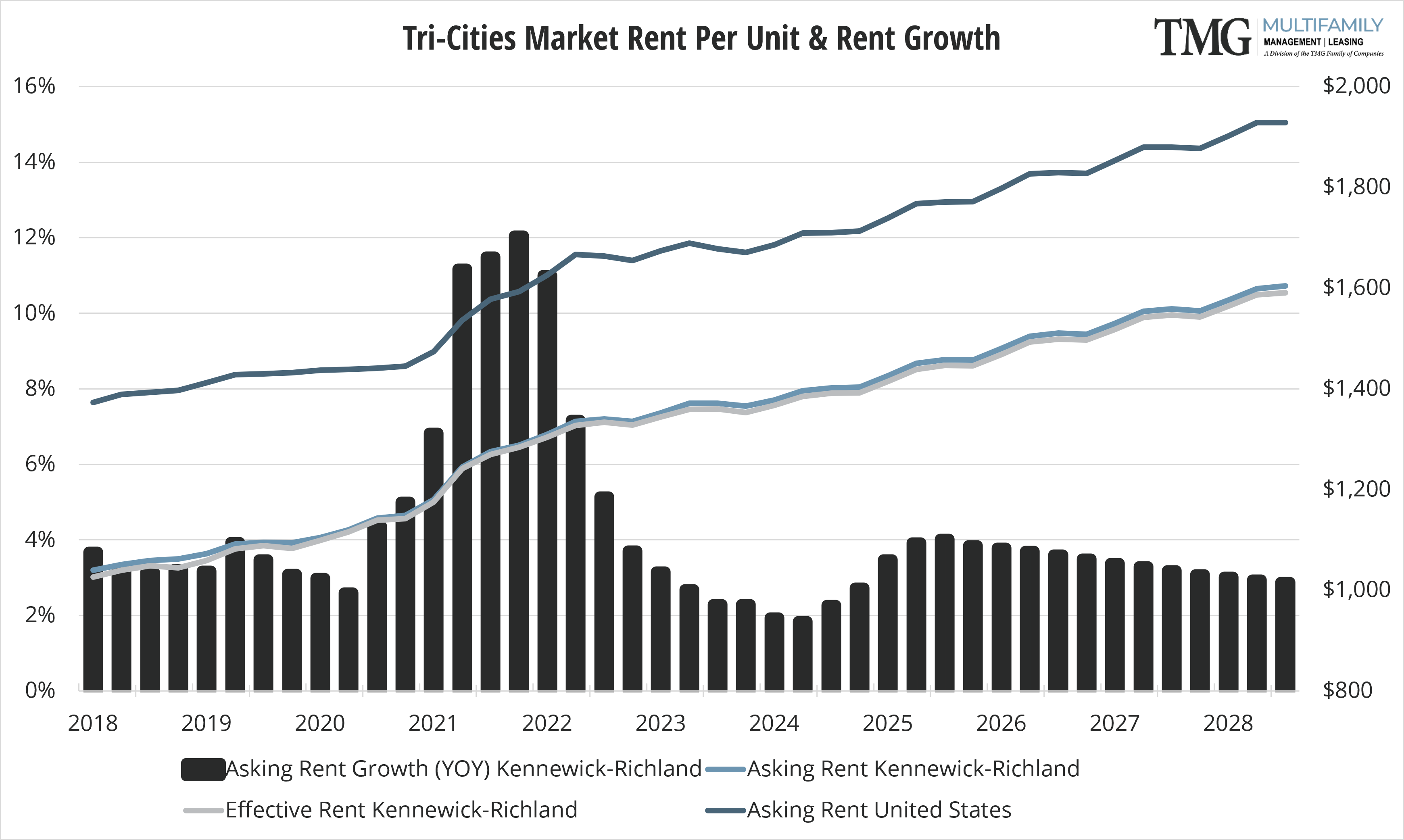

It’s intriguing to see Salem and Tri-Cities maintaining positive asking rent growth despite experiencing minor changes in vacancy rates and delivered units. Salem’s consistent performance, despite its lower average rent compared to other areas and national averages, underscores its resilience in the real estate market. Traffic has picked up in all four areas, as is seasonally expected, but again at a slower pace than in the last 2 years. The reported exit of population from Portland-Metro contrasts with potential in-migration to Vancouver and Tri-Cities. These two areas appear poised to continue to absorb additional units in 2024.

This Multifamily Market Pulse brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals for more than 30 years.

Carmen Villarma, CPM

President of the TMG Family of Companies

carmen.villarma@tmgnorthwest.com

(360) 606-8201

VANCOUVER

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

(360) 892-4000

PORTLAND METRO

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

(503) 718-5600

TRI-CITIES

30 S Louisiana St Ste 1

Kennewick WA 99336

(509) 591-4444

All data in this report is pulled from CoStar.