| Q3 • 2023 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

The abundance of new construction multifamily properties entering the market is creating an extremely competitive environment in the last half of 2023. It is now common to see a concession of 8 weeks free rent on new builds in the Portland and Vancouver markets. It appears that most new construction projects are trying to hold the line on projected rents and are offering larger concessions as a way to entice tenants to pay that higher rent. In this economic environment, that is proving difficult. Tenants are becoming more sensitive to ongoing rents, making it difficult to entice them with free rent incentives.

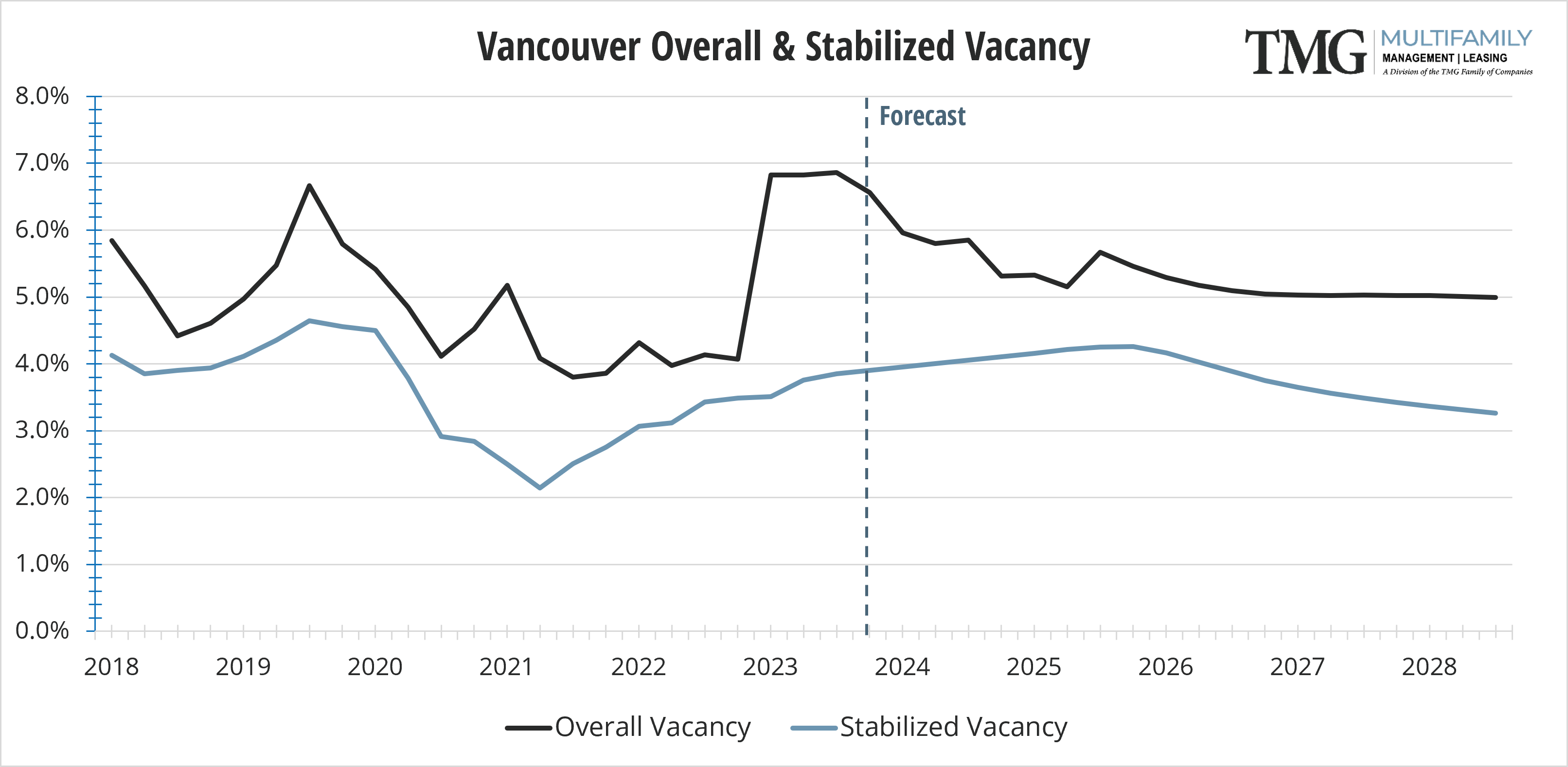

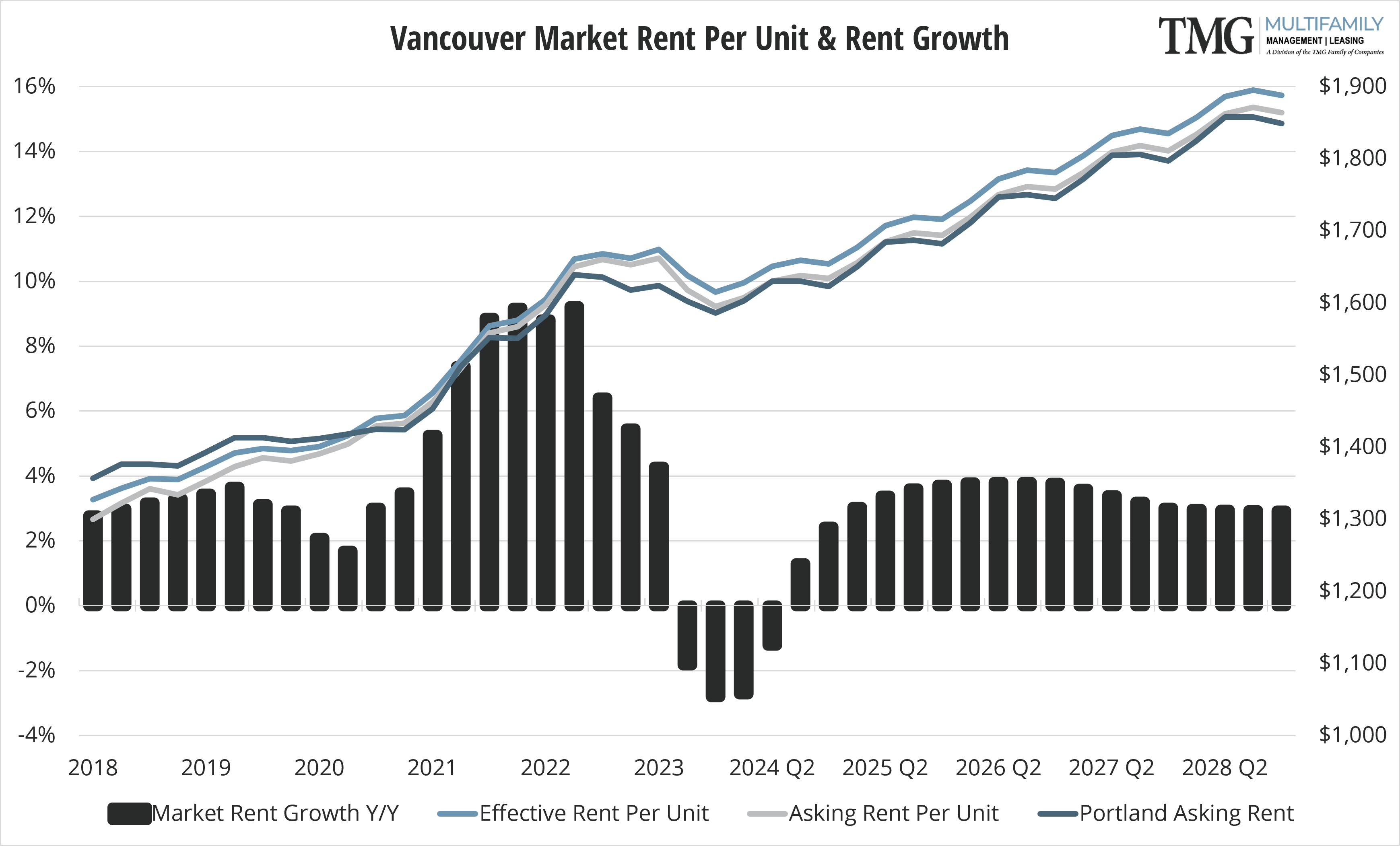

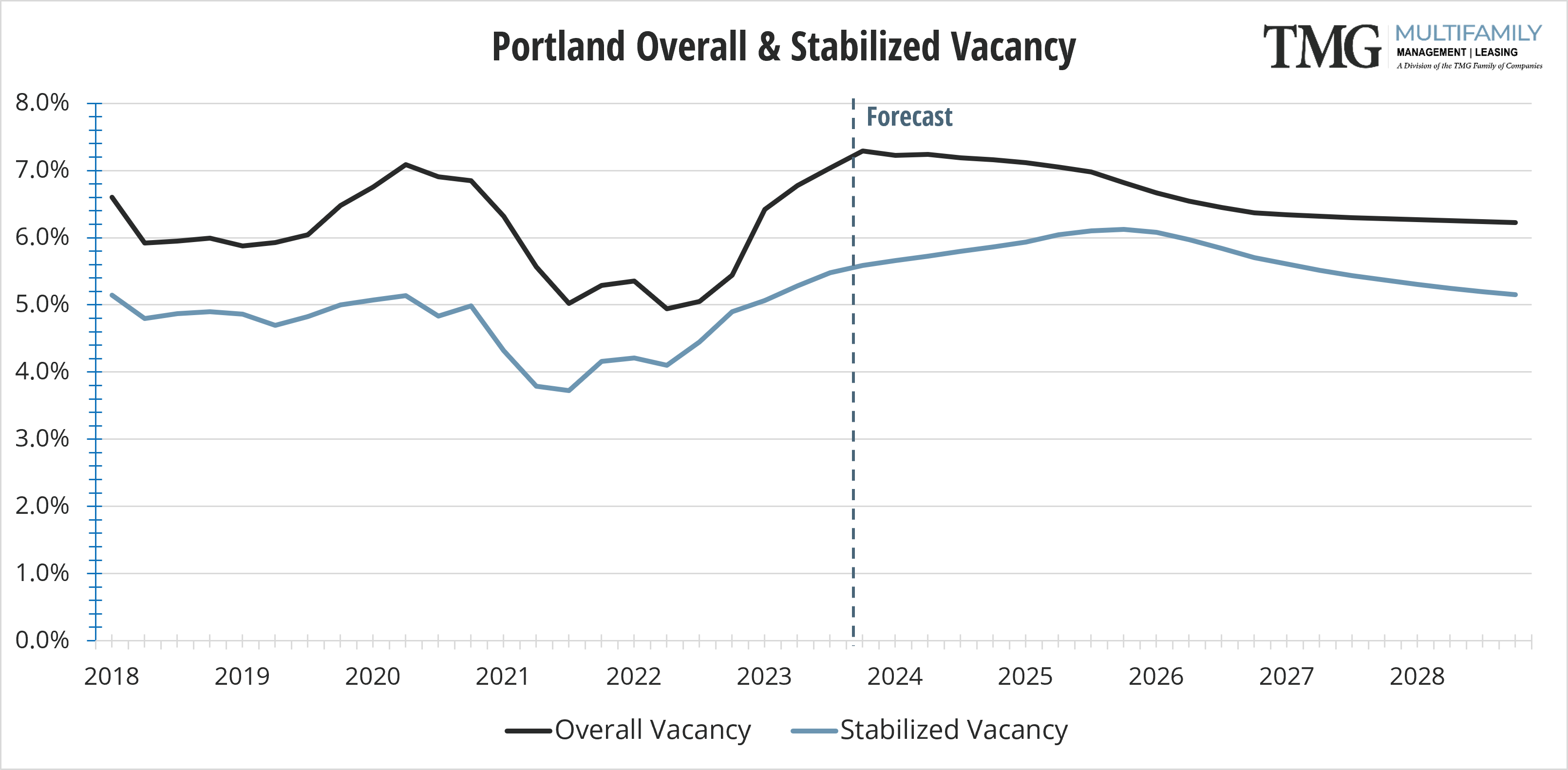

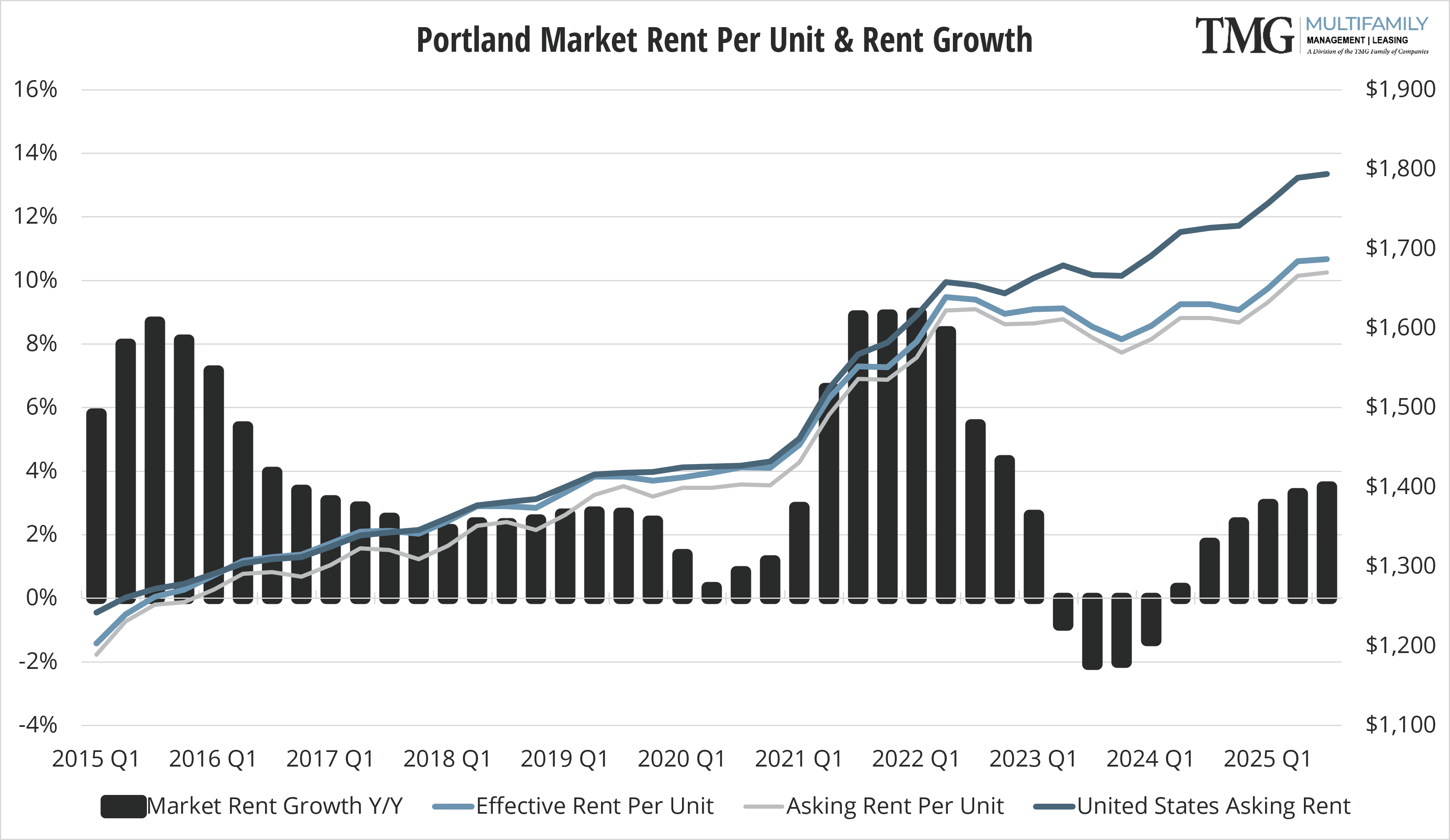

Concessions on new builds affect all other existing Class A & B properties, causing them to offer concessions to compete, although we typically see 4 weeks of rent concessions offered by existing projects rather than 8 weeks. Declining rent growth for the Portland and Vancouver markets continue. Vancouver had a rent growth swing from a positive 0.50% growth in Q2 to a -2.1% in Q3. Portland had already hit negative rent growth in Q2 and that escalated to a -2.0% in Q3.

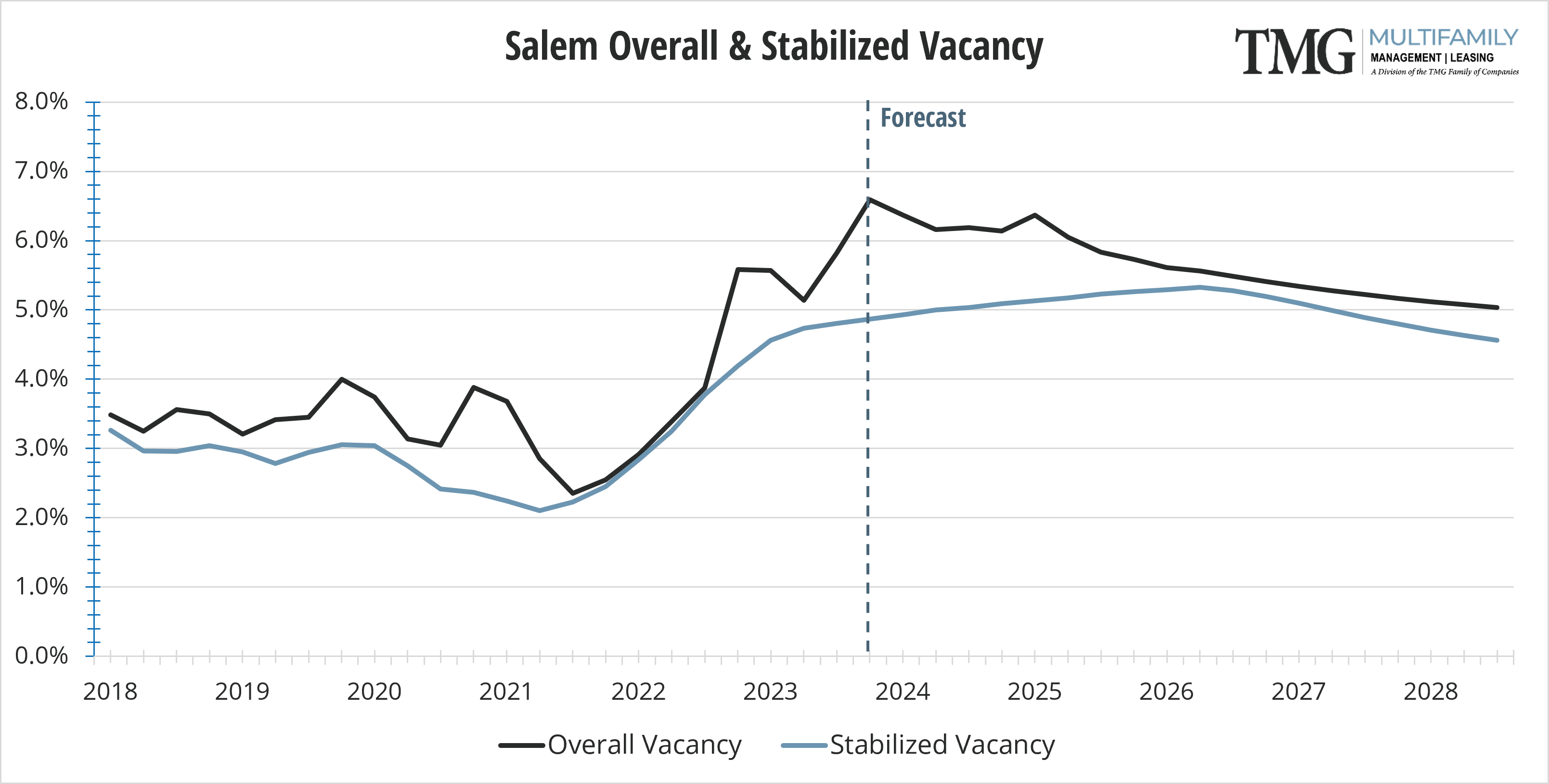

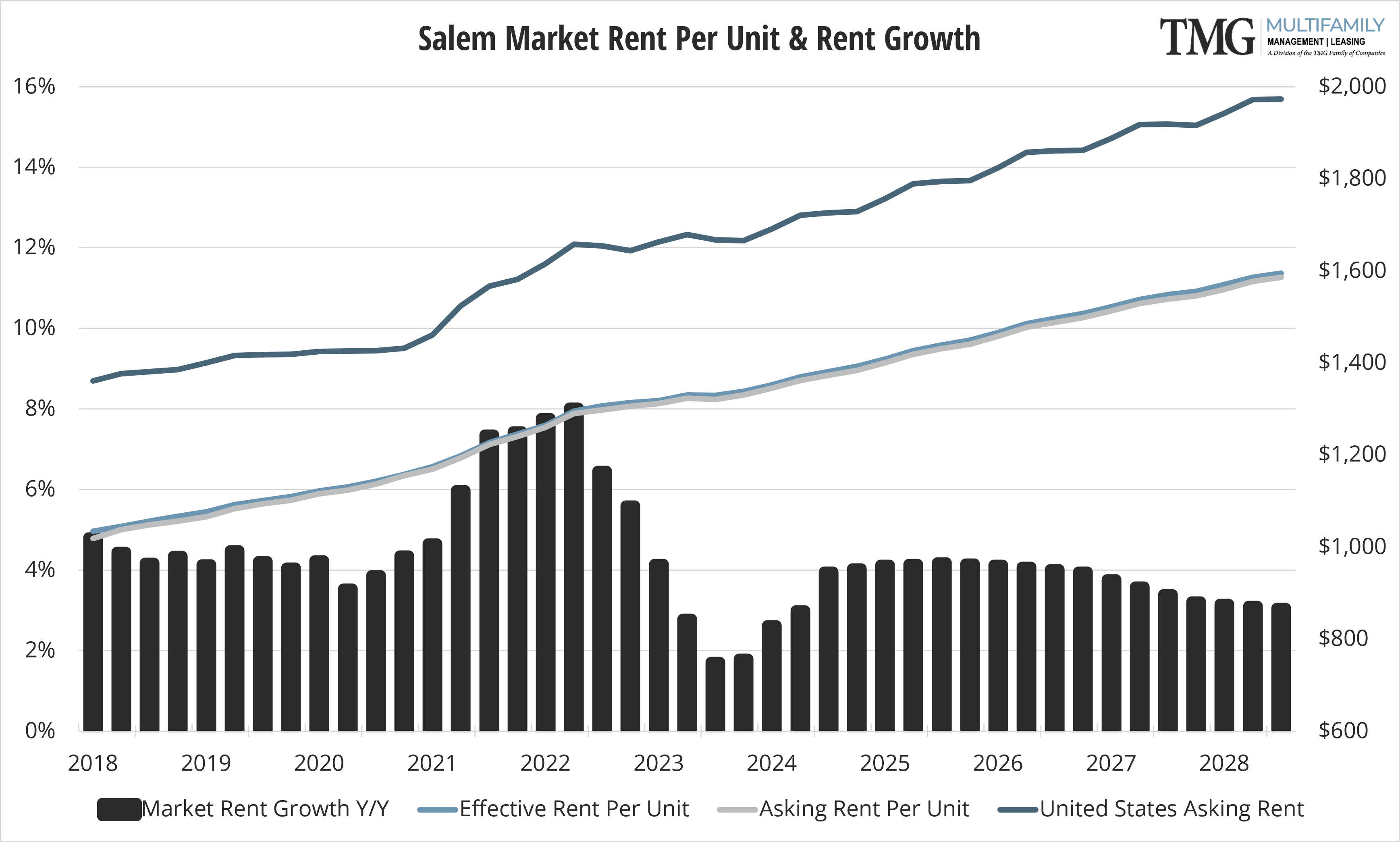

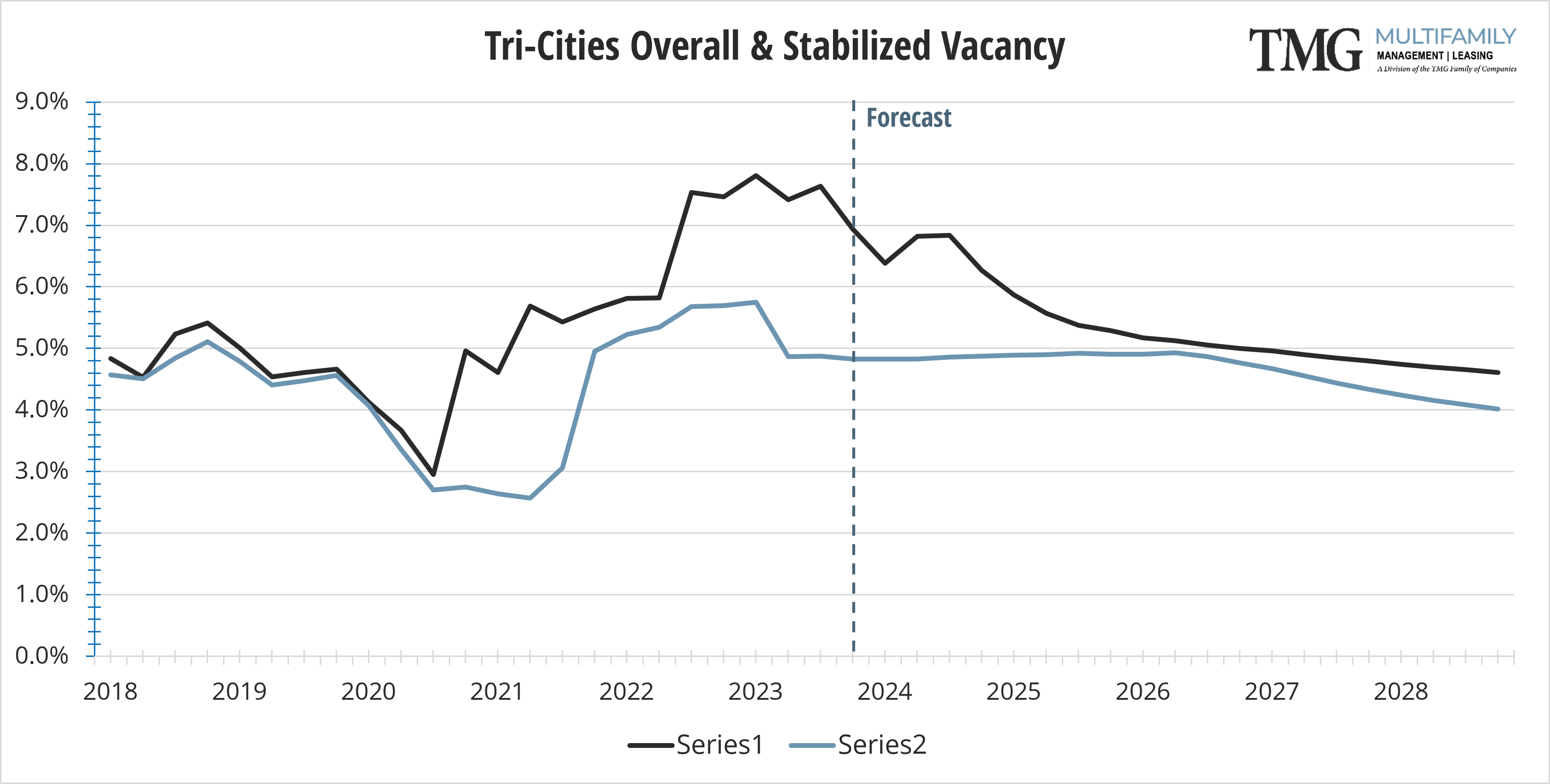

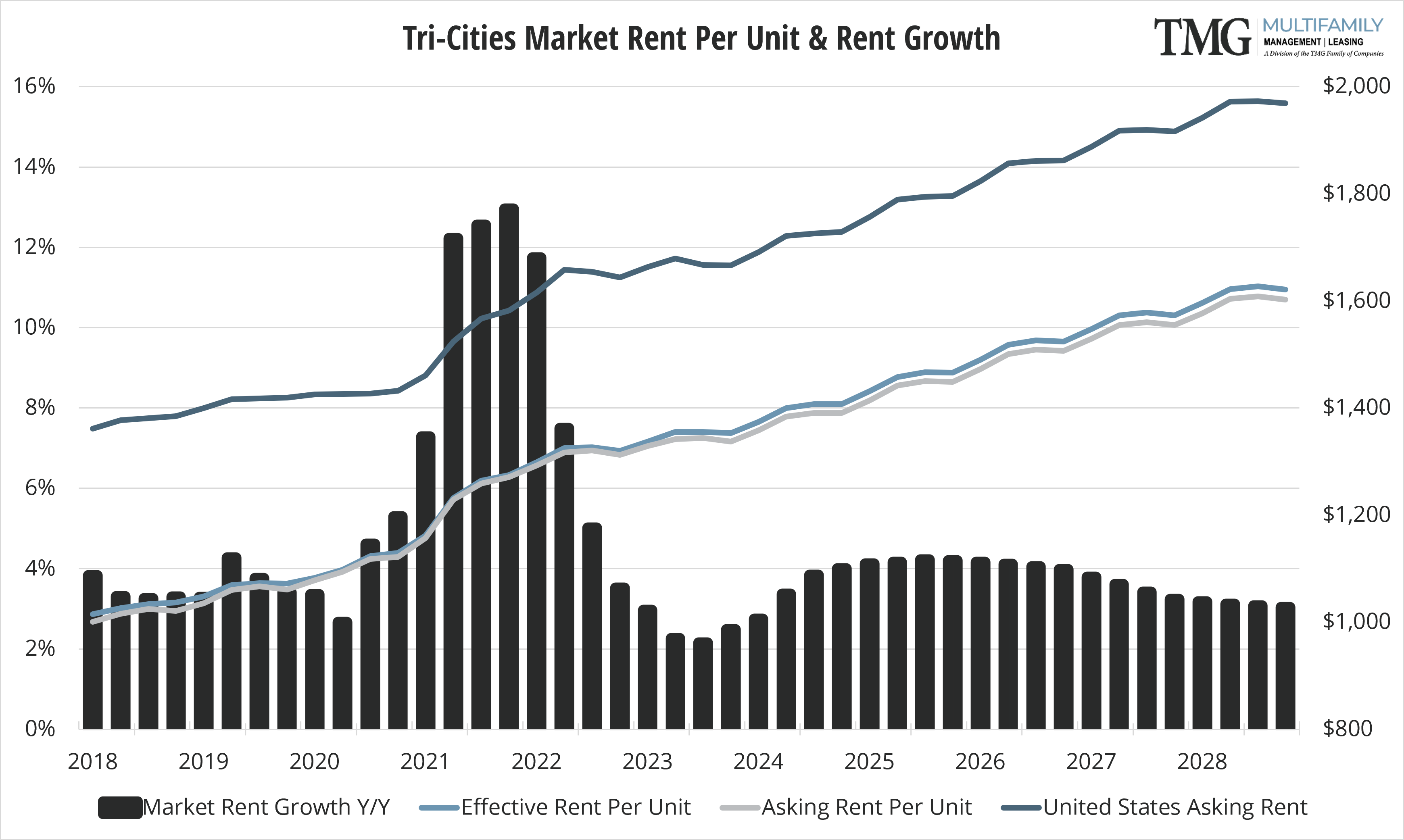

The Salem and Tri-City markets are faring better than Portland and Vancouver, even with new construction projects coming online in those markets. Both Salem and Tri-Cities are still experiencing positive rent growth, albeit in the 1.8% to 2.2% range. Salem’s vacancy rate at 5.8% leads the pack in holding onto the lowest vacancy rate even with an increase in delivered units in that market. It's interesting to note that the Tri-Cities market had a slight decrease in vacancy from 7.9% last quarter to 7.6% this quarter and a slight .2% increase in rent growth from Q2 to Q3. In this submarket, there have also been several hotels re-developed as apartments and that availability has driven up the number of available units to absorb.

As we prepare 2024 budgets, given the current market conditions, a strategy that is realistic about rents, renewals, and rent growth seems prudent. Long-term-hold clients are willing to accept slightly lower rents in return for higher occupancy and reduced turnover costs equaling improved cash flow.

It’s also worth noting that while there are still projects in the pipeline, the number of units in the proposed construction pipeline has decreased, indicating a potential stabilization in the market in the near future.

Monitoring these changes closely will be crucial in making informed decisions regarding pricing, incentives, and overall property management strategies.

This Multifamily Market Pulse brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals for more than 30 years.

Carmen Villarma, CPM

President of the TMG Family of Companies

carmen.villarma@tmgnorthwest.com

(360) 606-8201

VANCOUVER

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

(360) 892-4000

PORTLAND METRO

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

(503) 718-5600

TRI-CITIES

30 S Louisiana St Ste 1

Kennewick WA 99336

(509) 591-4444

All data in this report is pulled from CoStar