| Q4 • 2022 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

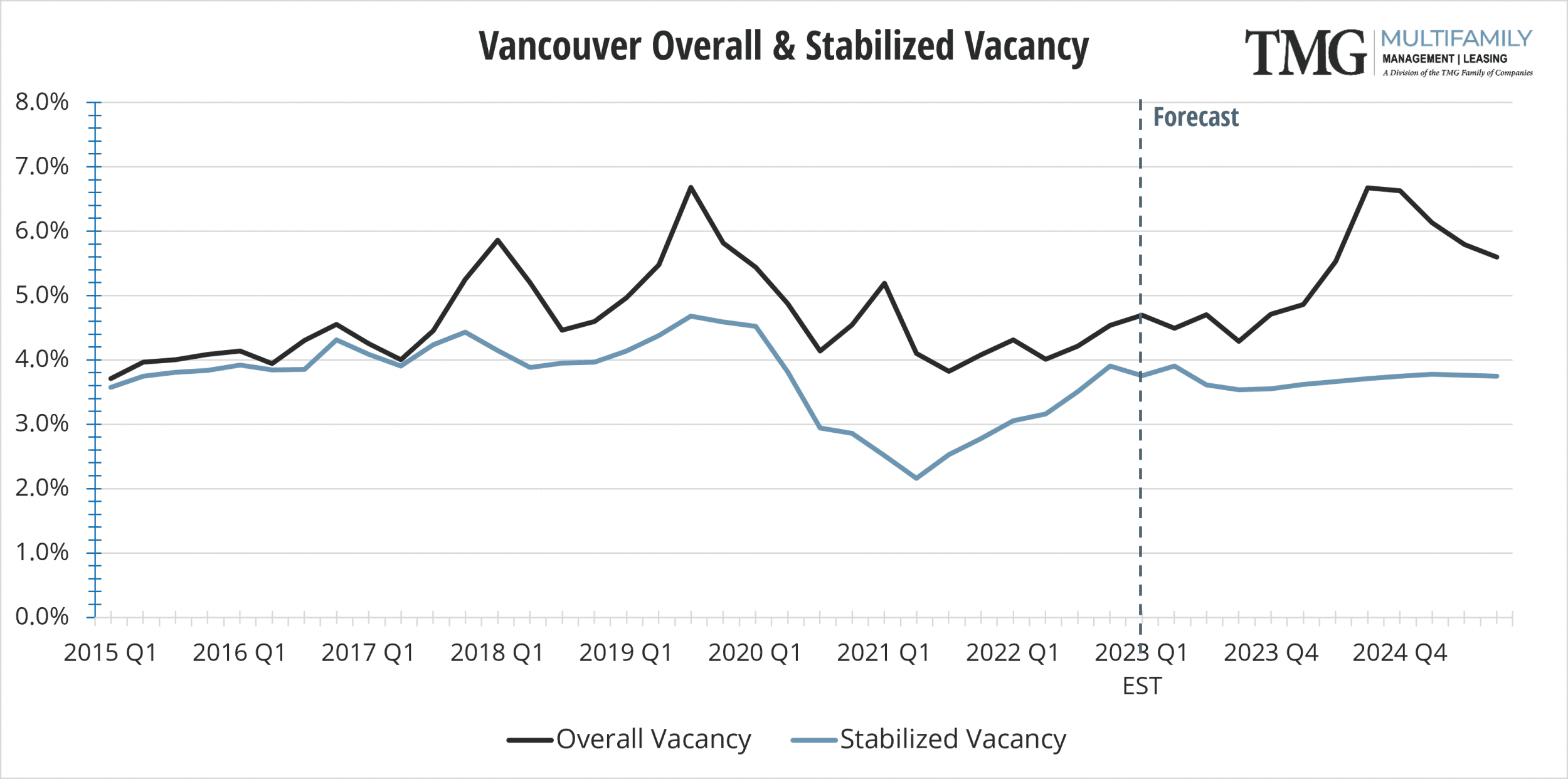

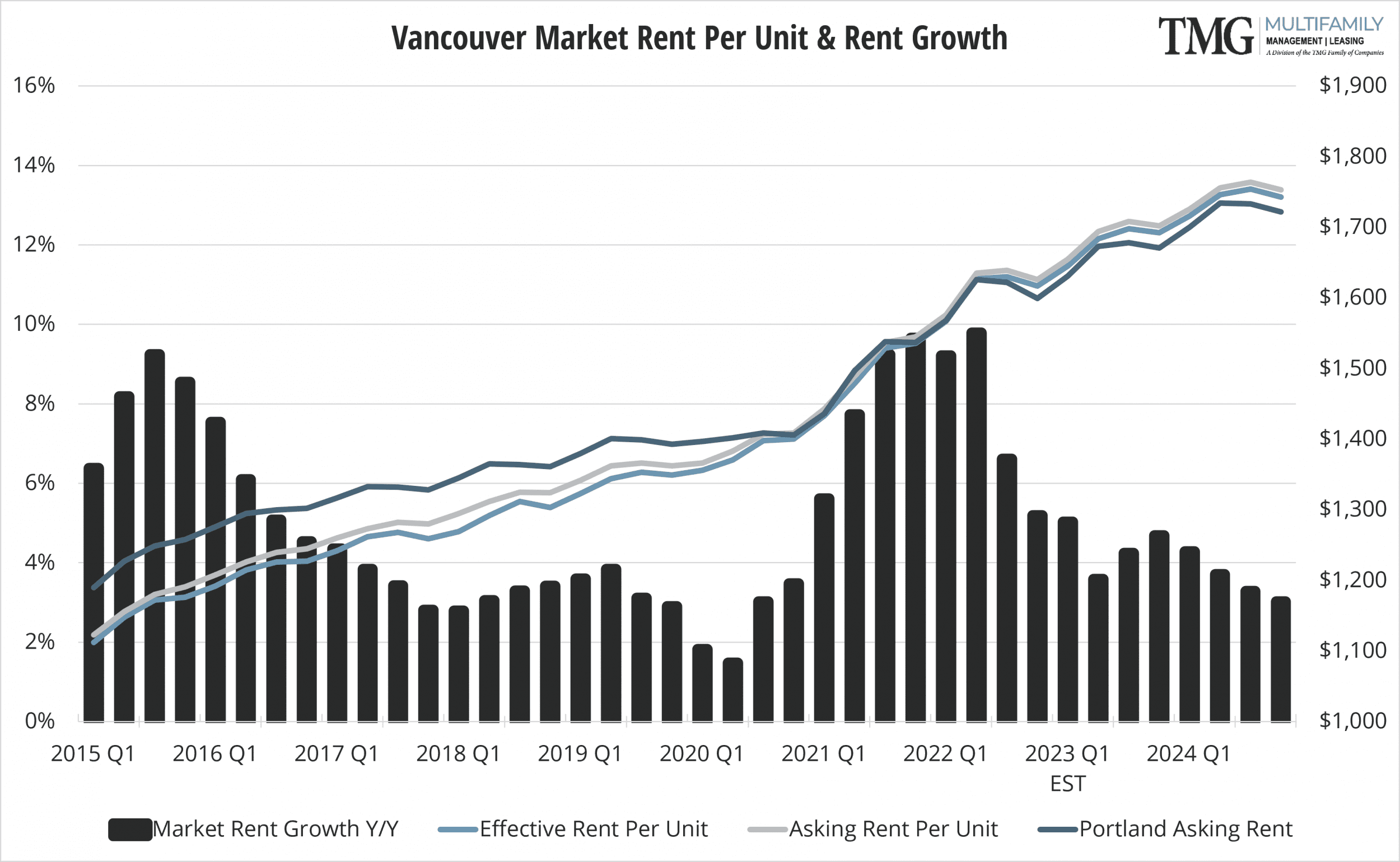

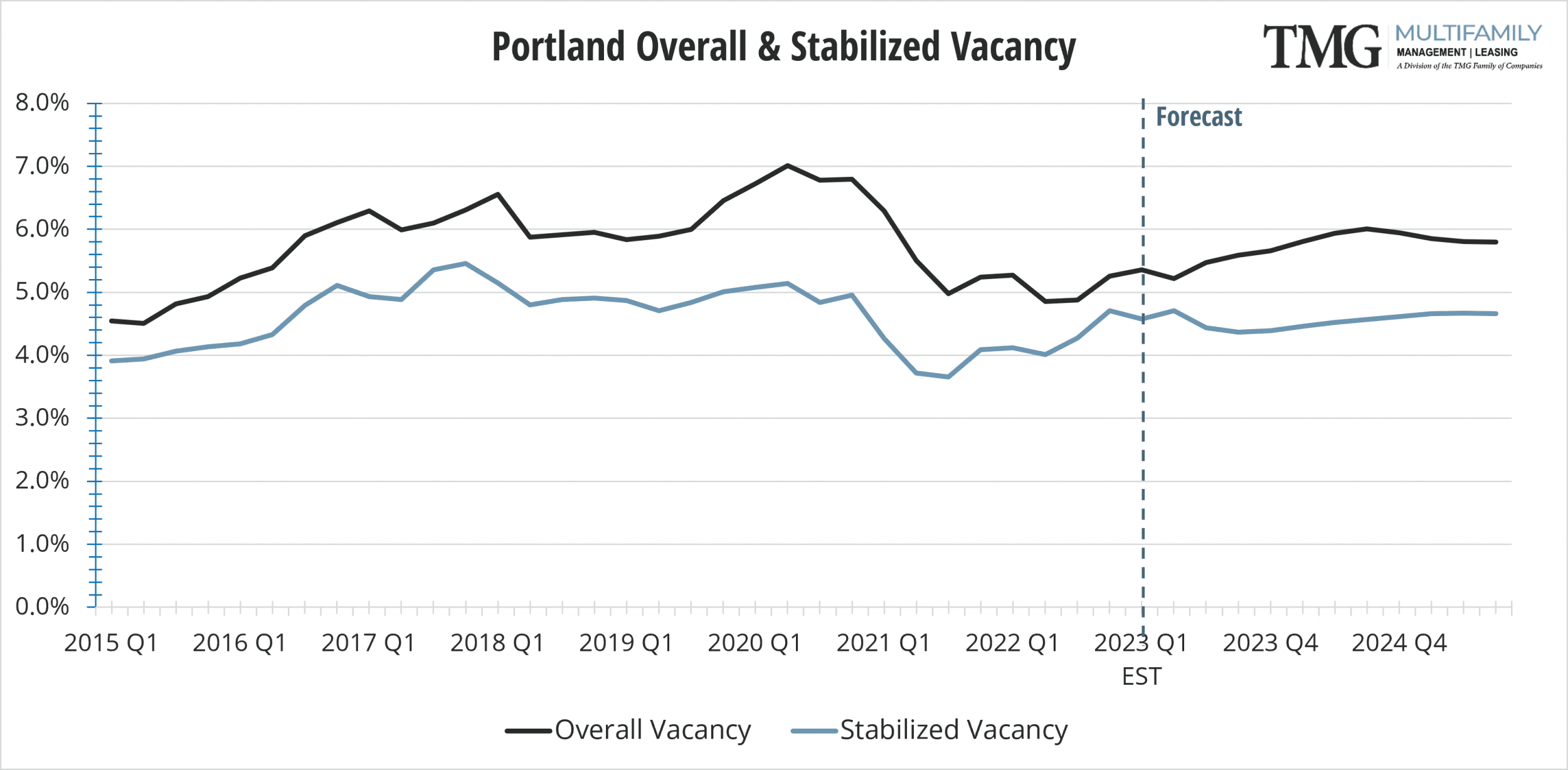

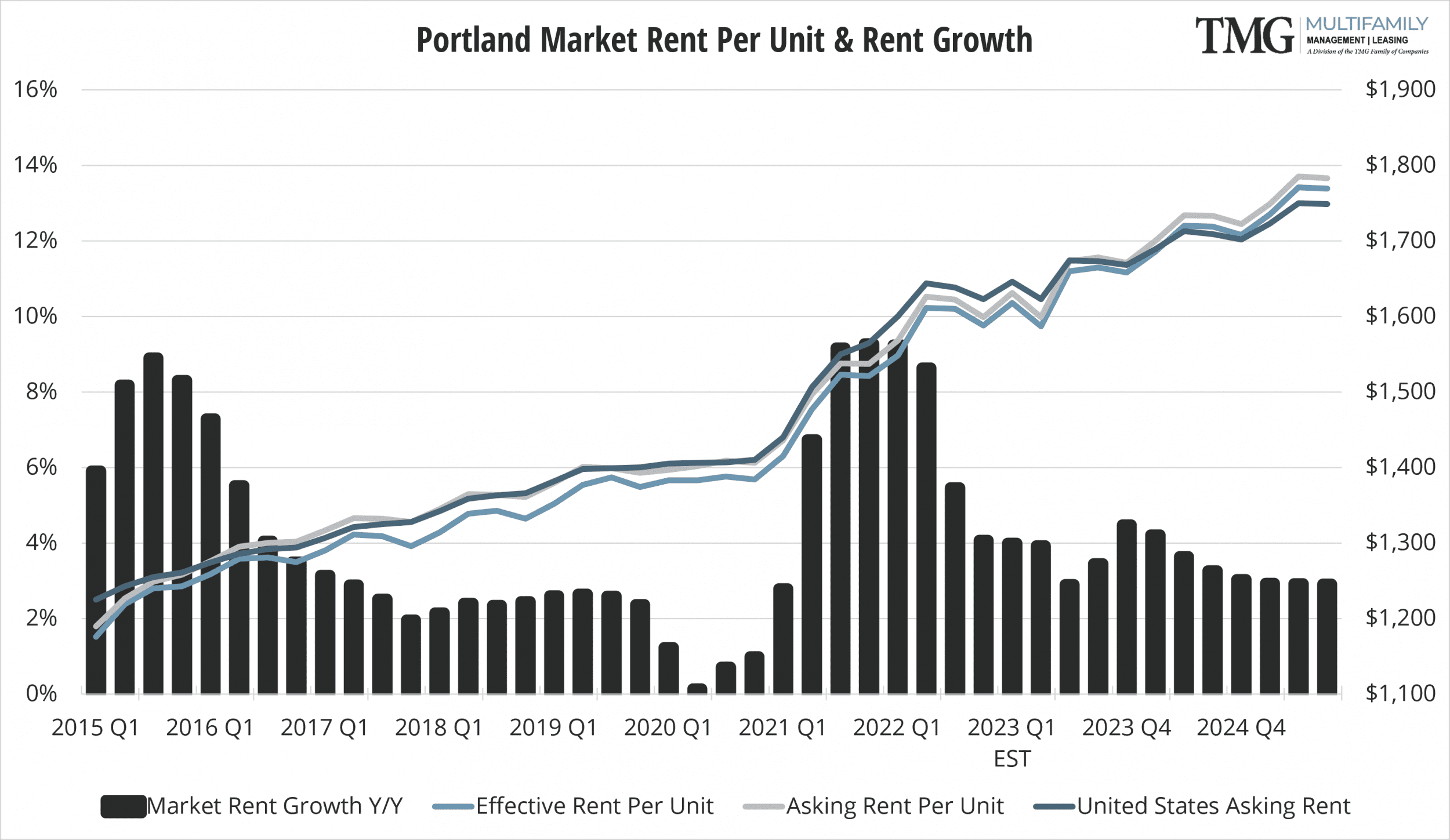

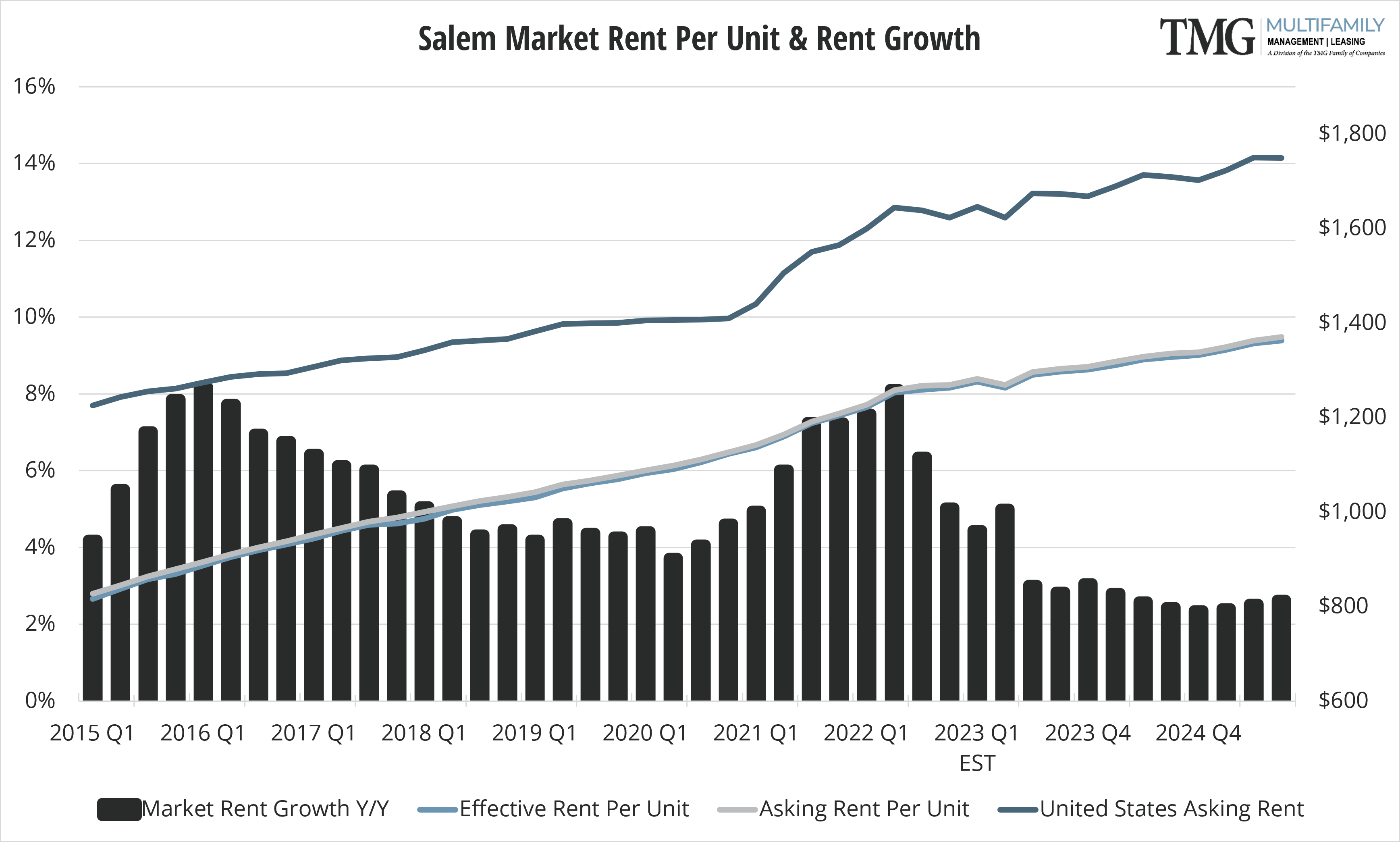

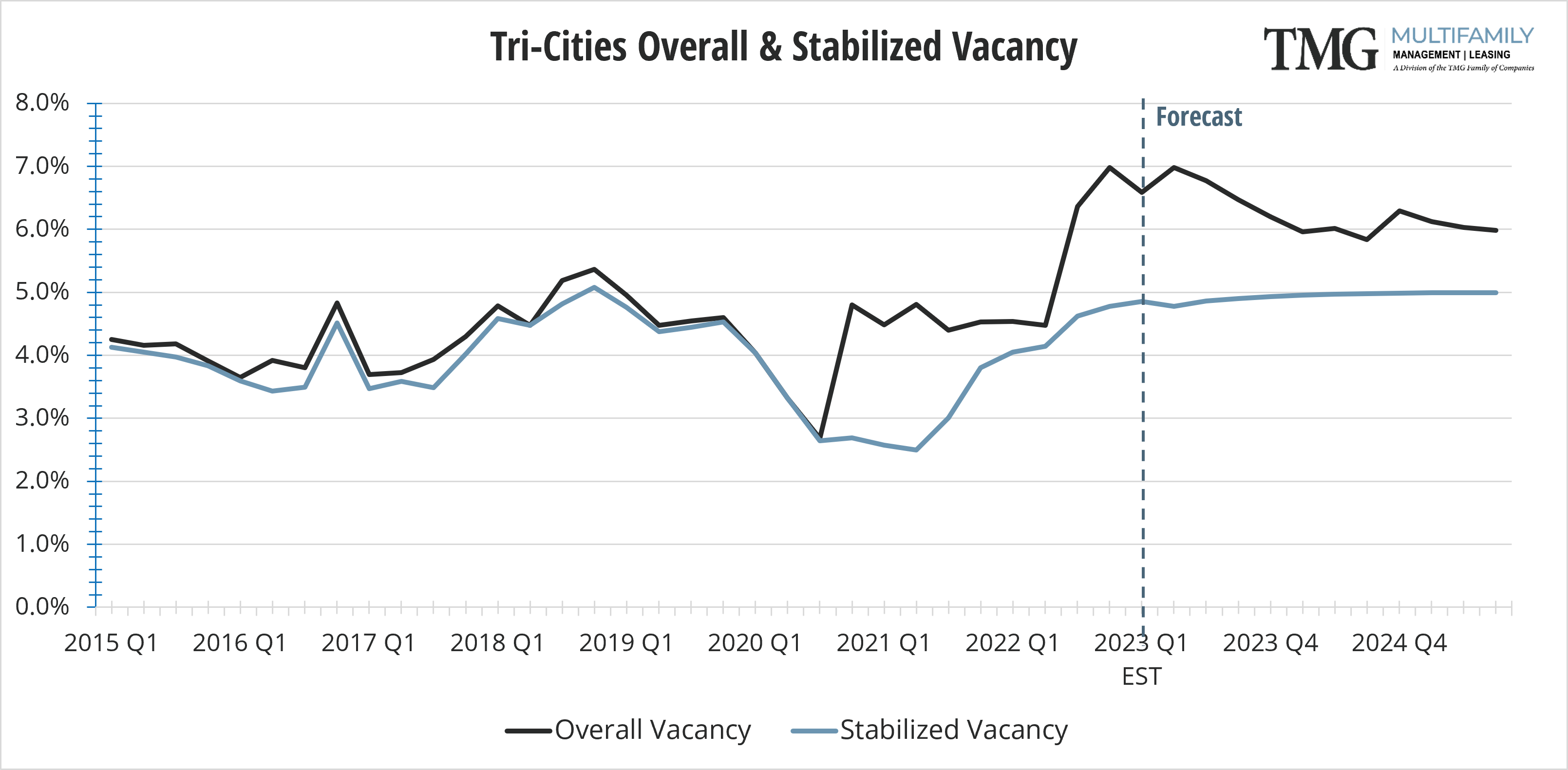

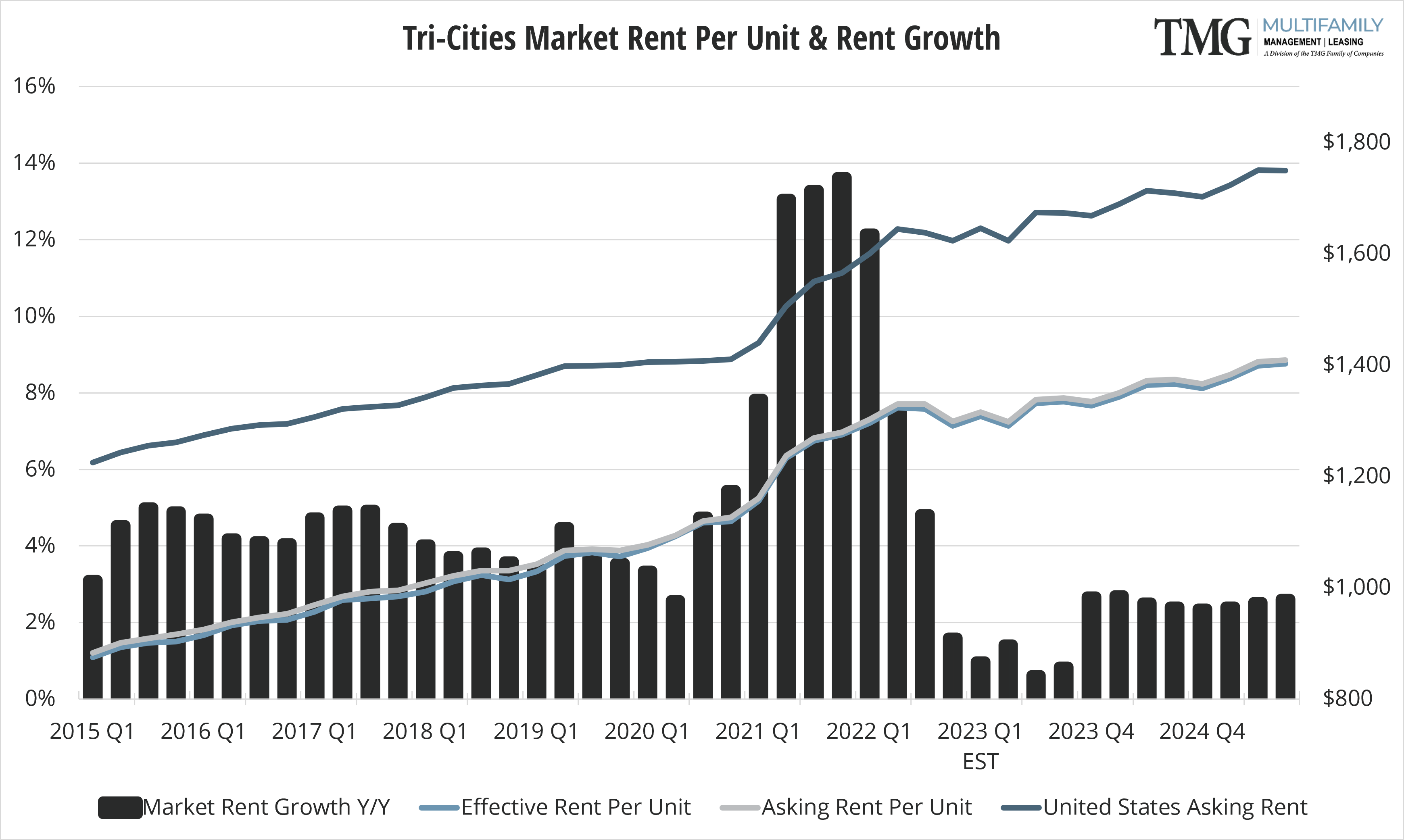

The story is the same across all markets as rents trend downward from the historical highs of 2021 and 2022. All markets are experiencing “churn” as turnover increases, although days vacant remain steady and rents while not at the all-time high levels, are still experiencing some growth. There is always seasonal slowdown in our region, and as we move into spring we will be able to determine how much this slowness is seasonal only and how much will stay with us as renters fight inflation. All markets have new construction units that will be released through spring and summer which will provide tenants more options as well as rent concessions. The markets overall are stabilizing; there is more moderate rent growth and hopefully only a healthy vacancy rate as we move through the Q1 and Q2.

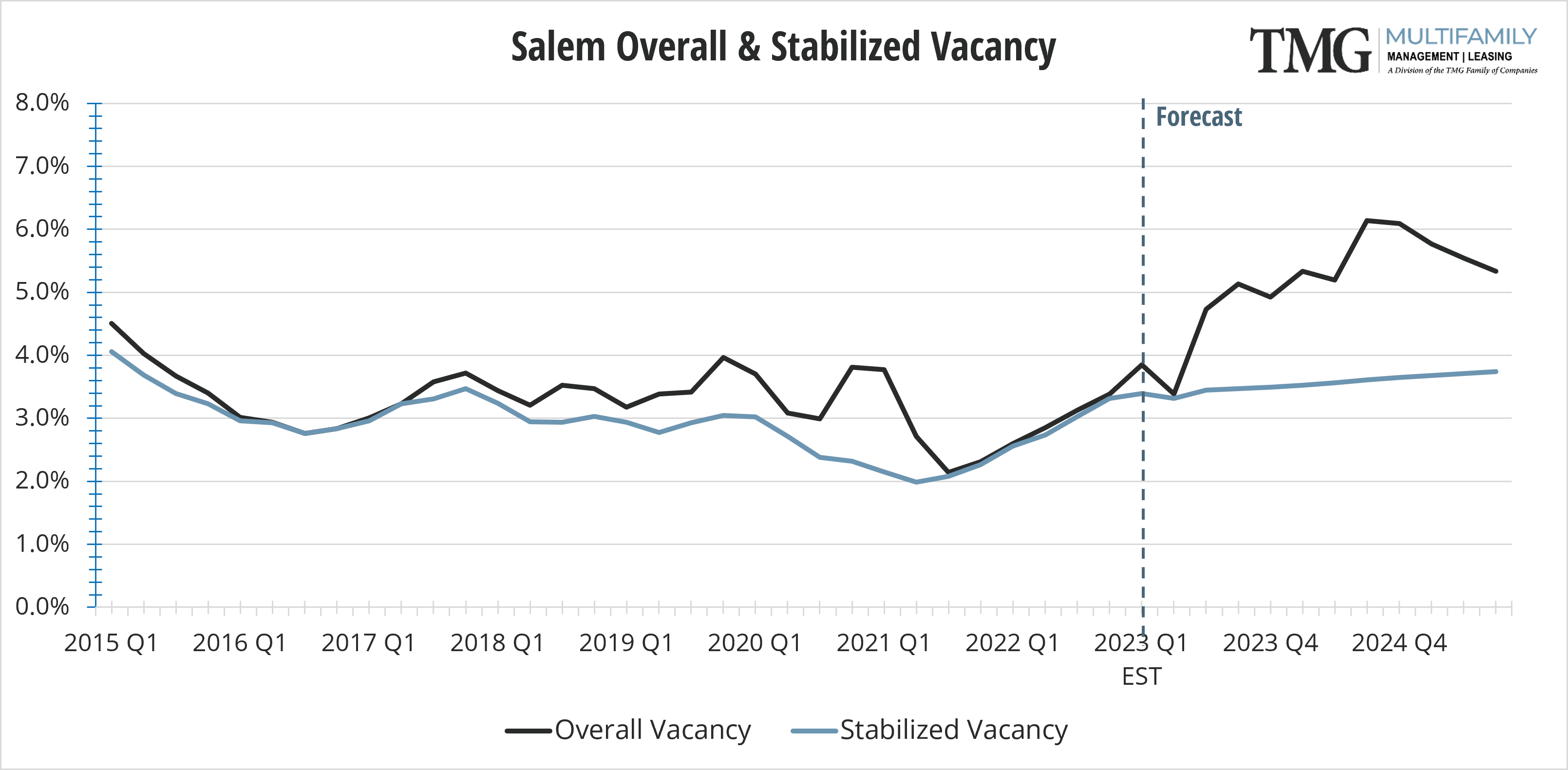

Salem, in past years had not seen the off the chart rent increases as did the other metro areas. However, they are also not seeing deescalating rents yet either as that market is noted for being more consistent with less highs and lows compared to other geographic markets. Vancouver/SW Washington is not thought of any longer as the bedroom community of Portland Metro. For rents, jobs, new industries and high-priced real estate, the area is on par with our neighbor to the south and many say will surpass the desirability of Portland and surrounding areas.

This Multifamily Market Pulse brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals for more than 30 years.

CARMEN VILLARMA

President, CPM

carmen.villarma@tmgnorthwest.com

(360) 606-8201

7710 NE Vancouver Mall Dr Ste B

Vancouver WA 98662

16520 SW Upper Boones Ferry Rd Ste 250

Portland OR 97224

698 12th St SE Ste 240

Salem OR 97301

30 S Louisiana St Ste 1

Kennewick WA 99336

All data in this report is pulled from CoStar