TMG Tonight is a video web series created by the TMG Family of Companies to provide strategies, tips, and insights that help us all become better investors, better board members, and better caretakers of our communities. TMG Tonight premieres every other Friday at 6pm on TMG’s YouTube Channel.

The TMG Family of Companies is a full-service real-estate company offering property management, HOA management, maintenance, and home sales.

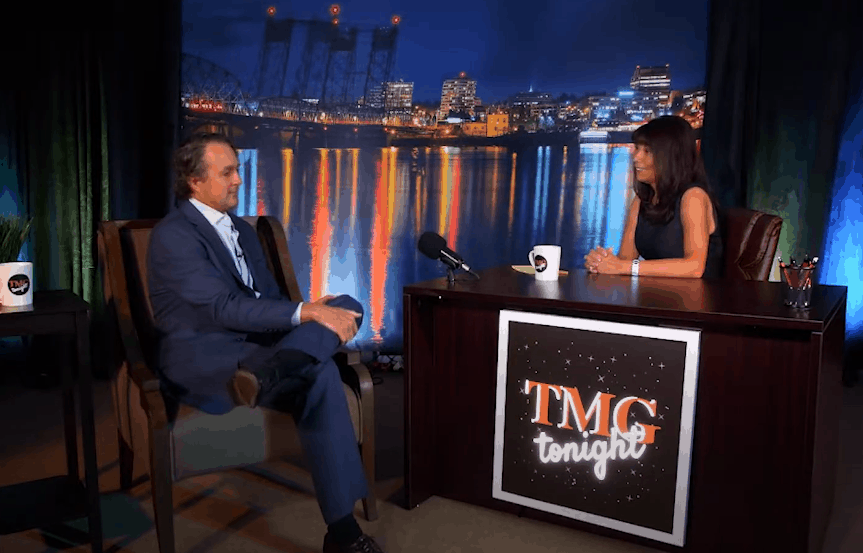

On a rainy Thursday evening in October 2020, at a small studio in downtown Vancouver, Washington, TMG’s President, Carmen Villarma, sat down with local real estate developer and investor Russ Campbell to film the first episode of TMG Tonight. Unrehearsed and unscripted (and following COVID-19 safety protocols), the two excitedly stepped in front of the camera to discuss diversifying investor portfolios, financing tips, and advice for investors who are just getting started.

By the end of the night, Russ had shared valuable insight for both seasoned and new investors, answering critical questions such as: “How do you find a good investment opportunity?” “What opportunities are available for investors right now?” And most importantly, “What will the future of real estate look like following COVID-19?”

Read on to discover Russ’ tips, tricks, and “secret sauce” for investors. Watch the entire first episode of TMG Tonight above.

But First, a Little About Russ Campbell

But First, a Little About Russ Campbell

“I’m a numbers guy…that’s the stuff I love.” – Russ Campbell

Russ began his investment career at the age of 20, when he bought a 4-unit apartment building that served as both his college living quarters and a first look into the real estate industry. Following that, he worked for a real estate development company in Maryland where he learned about commercial development, accounting, and finance before moving to the west coast with his family and pursuing mortgage finance. Though he dabbled in residential land development over the next 15 years, Russ did not truly begin his real estate investment career until the early 2000s, when he and his brother, Doug Campbell, partnered with a builder to develop a 42-unit subdivision in Bend, Oregon.

When the Bend subdivision was completed, Russ and Doug began developing in the Vancouver, Washington area. Eventually, their interests turned toward away from land development and toward investing in rental units. Their partnership with TMG began during the financial crisis, when they purchased some REO (real estate owned) properties that TMG was already managing. After that, Russ and Doug began developing multifamily apartments in the urban market of Portland, Oregon. One of their most recent projects is Galaxie at Sellwood, a 79-unit residential apartment building in Sellwood, Oregon.

Doug received his master’s degree in land planning and had been working as a consultant for many years in the Puget Sound, Washington and Portland, Oregon areas. Combined with Russ’ expertise in accounting and finance, the two make a powerhouse partnership in their Portland, Oregon-based real estate development company—CRG, Inc.

Finding a Good Investment Opportunity

When it comes to finding a new investment opportunity, “It depends a lot on where you’re at as an investor,” Russ says. The first property he bought was only four units because he could manage it himself and he had the funding for it. For entry level nvestors, smaller projects might be the better choice.

Having experience in all aspects of real estate from land development to mortgages and finance, Russ has developed some insightful tips for finding a good investment opportunity:

Do your research.

Talk to the current generation of renters (Millennials). Ask them where they like to live, what features they are looking for, etc.

Location, location, location.

Look at how surrounding properties are being managed. Identify services nearby that people will be looking for (transportation, shopping, restaurants, etc.)

Consider the number of units.

Larger investments are more cost-effective. If you have the capital, stay above 20 units. On bigger urban projects, stay at about 75 units. When you factor in the cost of on-site management and maintenance, you may want to go even larger—over 100 units.

The Best Real Estate Investments to Make Now

Investment to Avoid

Townhomes

This is the "secret sauce" right now. Demographically, there is going to be a wave of Millennials who want to get out of apartments and into a single-family structure as they get married and start families. They may not be able to buy a house right away. Townhouses are a great solution for those renters and have a good ROI.

Live/Work Properties

Properties that offer both a commercial space and residential space are in high demand right now with more people working at home because of COVID-19. Galaxie at Sellwood offers some live/work units, for instance.

Single Family Homes

Invest in properties in a 5-6 capitalization rate. Demand for single family homes is high, but so are the prices. Investors are betting on acceleration to continue. The obstacle is that you have a limited market of people who can afford the rent you need to receive to stay in the 5-6 capitalization rate. Townhomes fit this envelope better – they generally have a yard, garage, etc. that a single-family home has, but rents are more affordable.

Commercial Properties

Avoid investing in urban office space in the next 3-5 years, especially in downtown Portland. With everyone working remotely right now due to COVID-19, commercial properties and office retail are taking a loss. “I’m glad I’m not in office and retail,” Russ says. “I would avoid those right now.” There might be some great opportunities in a year or two, but not right now.

What Makes a Good Investment Strategy?

Find out what works for you.

For Russ, if he feels comfortable underwriting it and can evaluate the cash flow estimates and risks, he’s more comfortable following through on the asset.

Once the cash flow model is built, stress test it.

Figure out the worst-case and best-case scenarios. Make sure you can live with the worst-case scenario (and it doesn’t involve relinquishing the asset to the bank or going under financially).

Diversification is important.

One of Russ’ key investment philosophies is to diversify. Having a number of different property types (townhouses, apartments, etc.) and investing in different geographical areas is important. For instance, TMG is expanding into the Tri-Cities area. If you’ve got the capital to invest, don’t put it all into one building. Divide up your equity to protect yourself, even if that means buying smaller projects.

Mistakes are inevitable.

The market is ever-changing. The time between finding and opportunity and closing escrow could be a significant amount of time. If you have multiple investments, when something goes sideways, you won’t lose everything.

You’ve Found a Good Investment Opportunity. Now What?

It’s time to start the underwriting and lending process. As a philosophy, Russ and Doug make a habit of trying to match the debt term with the asset term. HUD loans are beneficial because they extend pretty far out—typically 35 years, sometimes 42 years if you are doing construction. However, HUD loans are complicated and expensive, so it is important to have good underwriters and brokers to work with you throughout the process. Brokers and underwriters can make or break the experience.

“Do your research,” Russ says. There are some HUD brokers that are not as transparent as others. Ask questions, for example, ask about how your rate can be affected when you lock it in.

Identify a good team of experts to work with.

According to Russ, “It’s kind of like three pegs on a stool. If one of those breaks, the deal is not going to work.” If you can’t get the financing and the lender backs out, it’s not going to work. If you don’t have a property manager to help you evaluate your revenue and expenses, you’re going to miss your model and possibly pay too much for the building.

Having all three key team members listed below is critical:

Tip for Existing Real Estate Investors during COVID-19

“Rates are the lowest they’ve been in my entire real estate career.” – Carmen Villarma

Vacancies and rent delinquencies are up right now because of COVID-19. But interest rates are lower than they have been in years. Now is the time to refinance. Russ has focused on refinancing his loans this year to take advantage of the historically-low rates. Refinancing at a lower rate helps to mitigate some of the loss of rental income due to vacancies and delinquencies.

The Future of Real Estate Investment

COVID-19 has been a real wake-up call in the modern era. Nobody thought it would be risky to invest in a small commercial retail building on Hawthorne, but now their tenants are all going under due to COVID-19. Nobody thought that a $50 million office building in downtown Portland would be empty and tenants would be trying to renegotiate their leases and move to the suburbs.

Hospitality and restaurants will be affected more than housing. There will be fewer restaurants and more commercial vacancies. People may have to be retrained into a new career. Structural unemployment is predicted for a while, and the government will have to step in. It should come back quickly once everything opens again, though it may take a few years to get back to where we were.

How is this different from the 2008-09 recession? The recession was more of a financial liquidity crisis and this is more of a demand crisis. There is less over-leveraging now, so there are fewer distressed properties.

We will get back to some normalcy within a few years. Once we get through this pandemic, the industry will change pretty fast.

Bonus Tip

People will be eager to travel and get out of the house. Plan next year’s travel now if you can because everyone else will be wanting to travel too, and it will be hard to find flights and hotels.